|

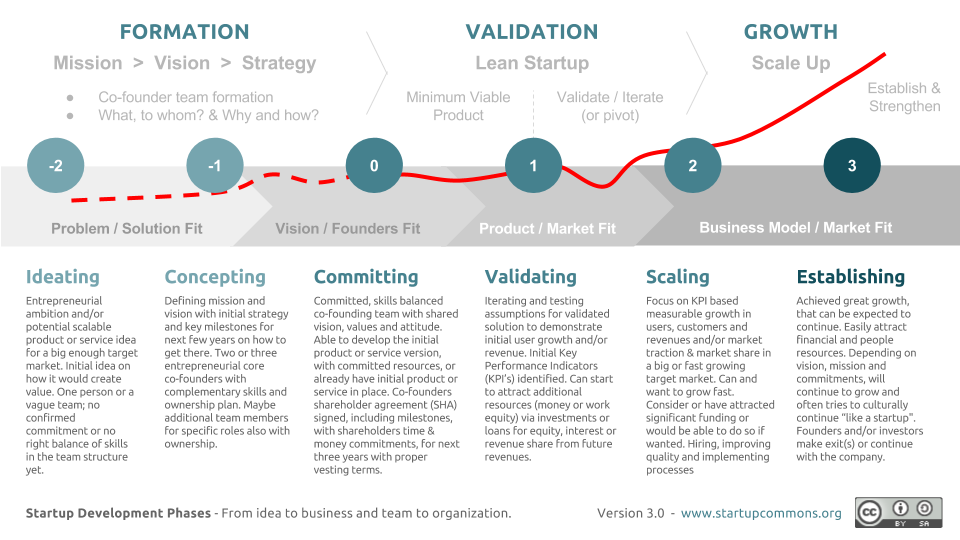

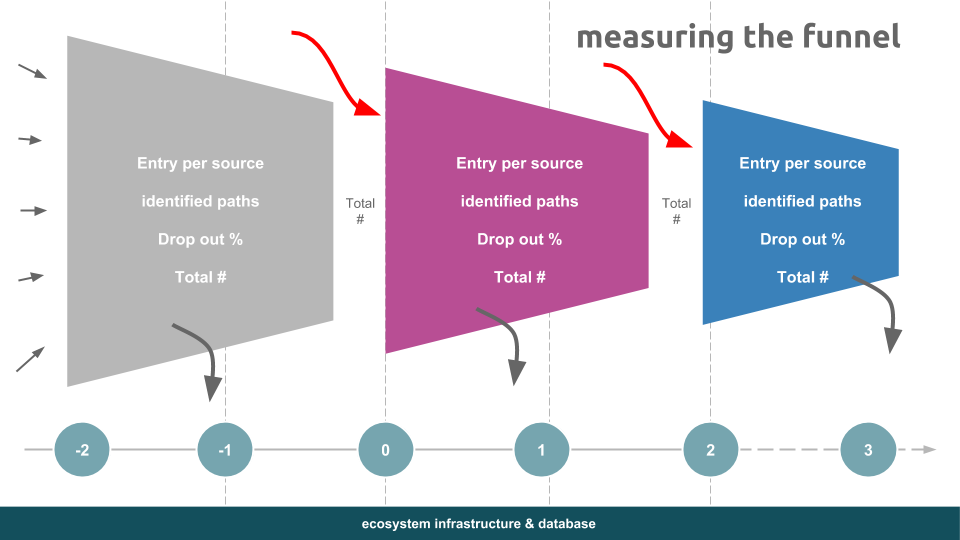

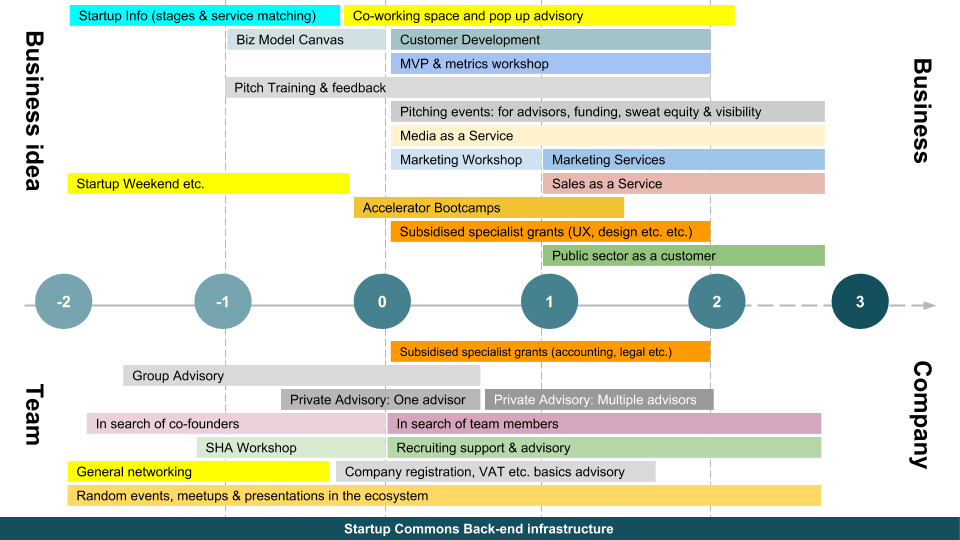

Key performance indicators (KPI’s) play a vital role in startup ecosystem financing. In addition to helping policy developers visualize and benchmark growth, KPI’s enable economic development organizations and support providers to make highly informed financial decisions. Does your organization want to learn how to save money, manage risk, and stimulate economic growth? It’s time to learn how to use KPI’s in startup ecosystem financing. Startup Development Phases Before implementing KPI’s, you must first understand startup development phases. Startups go through three phases: formation, validation, growth. During each phase, startups require different services, which is where support providers can assist. Specific KPI’s are relevant to each phase. For example, the number of new participants may be relevant during the formation phase, and the number of actions to validate assumptions may be a useful metric for the validation phase. Startup Growth Funnel As startups transition from one phase to the next, a certain percentage will fail and drop out of the process. Others will graduate from various programs and enter new ones as they move to more advanced phases. Entry sources, dropout rates, and numbers of participants are helpful KPI’s to track if you want to gather a holistic picture of the ecosystem and understand what support services, as well as ecosystem entry points, are the most promising. However, these KPI’s are virtually useless to ecosystem developers, unless they can act on them. It is essential that ecosystem developers, such as economic development organizations, tie their resource allocations to KPI’s. How can ecosystem developers accomplish this? Ecosystem mapping is the best place to start. Ecosystem Mapping Using Startup Commons’ Ecosystem Mapping Application, ecosystem developers can visualize support services in relation to startup development phases. When it is combined with KPI’s, the Ecosystem Mapping Application paints a clear picture of which support services are the most effective, and it highlights gaps in services that need to be filled. Ecosystem developers should use KPI’s when deciding how to allocate financial resources to support providers. With their funding contingent on KPI’s, support providers should allocate financial and educational resources to startups, based on the startups’ KPI’s. Let’s use an example. Suppose Accelerator A and Accelerator B both serve startups in the validation phase. However, Accelerator B has a 50% higher dropout rate for startups moving into the growth phase. Furthermore, startups in Accelerator B take 75% less actions to validate assumptions than startups in Accelerator A, and all other factors are constant. If ecosystem developers tie the accelerators’ funding to their dropout rates, then Accelerator B will have a high incentive to move more startups into the growth phase. Accelerator B can accomplish this by investing more financial and educational resources into helping its startups take actions to validate assumptions. Although scenarios are never usually this simple, the example illustrates how KPI’s can help ecosystem developers and support providers make better financial decisions, which will ultimately improve ecosystem outcomes. Rather than making blind investments, KPI’s enable financiers to structure agreements where funding is contingent on outcomes and incentives are properly aligned. Measuring KPI’s Startup Commons’ KPI Data Dashboard makes it easy for ecosystem developers to monitor and measure KPI’s throughout their ecosystems. If you are interested in tracking KPI’s or mapping your ecosystem, please reach out to us through the form below. We can also teach you more advanced financial engineering and hedging strategies to improve your startup ecosystem financing. |

Supporting startup ecosystem development, from entrepreneurship education, to consulting to digital infrastructure for connecting, measuring and international benchmarking.

Subscribe for updates

Startup ecosystem development updates with news, tips and case studies from cities around the world. Join Us?Are you interested to join our global venture to help develop startup ecosystems around the world?

Learn more... Archives

December 2023

Categories

All

|

- Startup Commons

- Business Creators

-

Support Providers

- About Support Providers

- Learn About Startup Ecosystem

- Startup Development Phases

- Providing Support Functions

- Innovation Entrepreneurship Education

- Innovation Entrepreneurship Curriculum

- Growth Academy eLearning Platform

- Certified Trainers

- Become Growth Academy Provider In Your Ecosystem

- Growth Academy Training On-Site By Startup Commons

-

Ecosystem Development

- About Ecosystem Developers

- What Is Startup Ecosystem

- Ecosystem Development

- Ecosystem Development Academy eLearning Platform

- Subscribe to Support Membership

- Ecosystem Operators

- Development Funding

- For Development Financiers

- Startup Ecosystem Maturity

- Case Studies

- Submit Marketplace App Challenge

- Become Ecosystem Operator

- Digital Transformation

- Contact Us

- Startup Commons

- Business Creators

-

Support Providers

- About Support Providers

- Learn About Startup Ecosystem

- Startup Development Phases

- Providing Support Functions

- Innovation Entrepreneurship Education

- Innovation Entrepreneurship Curriculum

- Growth Academy eLearning Platform

- Certified Trainers

- Become Growth Academy Provider In Your Ecosystem

- Growth Academy Training On-Site By Startup Commons

-

Ecosystem Development

- About Ecosystem Developers

- What Is Startup Ecosystem

- Ecosystem Development

- Ecosystem Development Academy eLearning Platform

- Subscribe to Support Membership

- Ecosystem Operators

- Development Funding

- For Development Financiers

- Startup Ecosystem Maturity

- Case Studies

- Submit Marketplace App Challenge

- Become Ecosystem Operator

- Digital Transformation

- Contact Us

RSS Feed

RSS Feed