|

Today, it's not hard to stumble across success stories of companies raising capital in alternative ways. By alternative, we mean not using banks or traditional lenders or even business angels. Since the financial crisis of 2007, anyone starting a business has realised raising capital is one of the hardest tasks and a critical area of the business plan. This demand for alternative funding mechanisms has given a rise to a growing industry already estimated to be worth billions of dollars. According to recent research published by The Economist, in 2014 global investment in fintech reached $12 billion, up from $4 billion a year earlier. In addition, Goldman Sachs estimates that global revenues linked to the growth of fintech could be as high as $4.7 trillion. Taking a step back, it's important to realise that funding is just one (important) piece of the puzzle. In addition to securing capital, there is a myriad of resources, services and environmental factors that are critical to startup development. Timely access to professional services (such as legal, tax, accounting and developers / programmers) plays a positive role for startups to succeed. As a result, today we are witnessing the growth of ecosystems designed to support startups and small enterprises in many cities around the world. In dedicated areas or business hubs, incubators, accelerators and shared office spaces, knowledge sharing and mentor services form networks that support thriving business activity. These groups of experts assist startups and ensure they have access to timely knowledge and information they need, beyond capital requirements. In addition, many governments around the world have rolled out new regulations covering equity crowdfunding or P2P lending and online digital investments. Governments are taking active steps to keep up with innovations in finance by providing frameworks and an environment in which operators and participants can transact safely and efficiently. As startup ecosystems grow, so do the associated services that support them. At this highest level of small enterprise planning, neural networks or sophisticated platforms that monitor and manage them connect all stakeholders in real time and with access to critical business data. By using these networks, it is possible to better plan, measure and drive the growth of startups, identify bottlenecks and better allocate resources to them. This is an edited version of an article originally published at http://www.growadvisors.com/blog/funding-startups-and-keeping-a-track-of-the-bigger-picture by Grow Advisors. You are free to re-edit and re-post it under Creative Commons Attribution 3.0 License terms by giving credit to the author with a link to www.startupcommons.org and the original post. Photo credit: Pictures of Money, https://www.cheapfullcoverageautoinsurance.com/. The photo was originally published on Flickr. It has been used to illustrate this text under Creative Commons Attribution 2.0 License terms. No changes have been made.

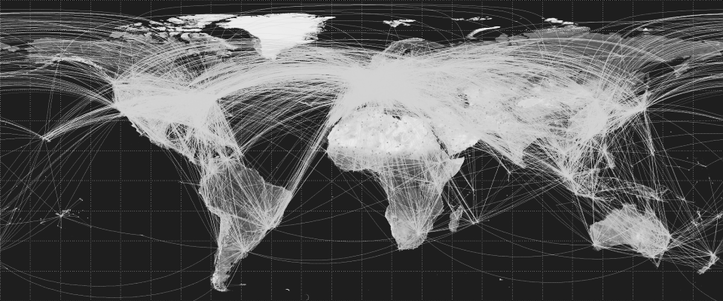

This is an edited version of an article originally published at https://blog.criterionconferences.com/socialtech/fintech-ecosystem-innovation-disruption-collaboration/#authorprofilebox by Dr Vijaya Thyil, Senior Lecturer in Accounting and Finance at Swinburne Business School, Swinburne University of Technology. You are free to re-edit and re-post it under Creative Commons Attribution 3.0 License terms by giving credit to the author with a link to www.startupcommons.org and the original post. Photo credit: Got Credit, http://www.gotcredit.com/. The photo was originally published on Flickr. It has been used to illustrate this text under Creative Commons Attribution 2.0 License terms. No changes have been made. Technological innovations focusing on the financial industry have led to a rapidly growing new ecosystem called Fintech. A biological ecosystem generally comprises of organisms portraying continuously evolving relationships in a specific climate, leading to complex, non-linear structures. This is exactly what we are seeing with the Fintech entities. The economic climate is just right! The breakdown of trust due to the recent financial crisis has meant that society perceives a brick-and-mortar financial institution no different to a cloud entity! Simultaneously, the extensive use of smartphones and Web 3.0, the uncontrollable rise of consumer debt levels and the massive increase of international financial flows have made the conditions ripe for Fintech to thrive. However, due to the recentness of this ecosystem, the timescale of the entities is in its embryonic stage. That is how quickly a Fintech is born; when and how it dies; how it exits, say through an IPO or acquisition; nested versus non-nested structures; the social impact of Fintechs and so on are continuing to be recognized as they occur. We keep hearing the term ‘disruption’. Why? At first glance, the emerging scenario appears quite simple: Fintech companies – mainly young, entrepreneurial startups – are producing innovative digital technologies to improve the customer experience, efficiency and range of the financial services such as lending, payments, retail and institutional investments, equity financing, and remittances. Entrepreneurship, financial development and digitisation are not new, right? Why then are we referring to a ‘disruption’? Well, the rapid speed at which the innovations are being created, commercialized and embraced by the society globally means that traditional business models of financial services are collapsing or being swiftly dismantled and recreated. One would expect the time period to be disruptive and groundbreaking. How would you describe the collaborators? While the convergence of entrepreneurship, financial services and digitisation necessarily means the involvement and collaboration of multiple entities, the synergy created by the Fintech ecosystem is much larger due to the fundamental, intrinsic and pervasive influence of both financial services and digital technology in our day-to-day lives. So we are seeing startups, seasoned entrepreneurs, local and foreign investors, venture capitalists, financial institutions, insurers, wealth managers, governments, telecom providers, retailers, corporations, consumers, educational institutions and specialist consultants who then get networked into hubs, accelerators, incubators and so on. The birth of new entities in the ecosystem occurs from both serendipity as well as planned innovations. The collaborations are customized, proactive and dynamic. For instance, banks are working with startups to ensure that the innovations produced match their needs, and investors and VCs are willing to direct huge capital towards these startups because of high returns. Furthermore, financial institutions are also starting to provide greater funding for Fintech companies to get access to new products in a shorter timeframe. Governments are very supportive of Fintech due to the increase in jobs, skilled workforce and inflow of capital, and are trying to provide attractive environments for Fintech companies to thrive in. In particular, how is the academia–Fintech collaboration occurring? The academia’s collaboration with the Fintech ecosystem is occurring through several streams. The Entrepreneurship, Finance and Banking, IT and Communications disciplines are supplying the founders of Fintech startups. Universities and centres are providing mentoring programs and boot camps, sponsoring student-led Fintech clubs and allowing the use of their campus spaces for Fintech meets and events. Academic research is evolving around data analytics, cybercrime and fraud protection, network analysis and Fintech business models with new academic and practitioner journals being founded for disseminating the research. Technology companies in turn are partnering with Universities by setting up Chairs focused on expertise in finance, digital technologies and entrepreneurship to facilitate the rapid and smooth knowledge transfer and commercialization of academic research. Are you a consultant or an entrepreneur?

- Learn more about Growth Academy Online Training & Certification Programs Download our startup booklet and watch our videos to learn more about our framework to help startups to grow without "reinventing the wheel" and without wasting lot of time trying to connect the dots. The framework is based on the startup development phases and aims to remove the highest universal risks on the startup journey. The private investment sphere has long been a traditional domain of private equity and venture capital firms. However, in recent years, many institutional and retail investors have increasingly taken an interest in investing in this exciting and promising sector. Many hedge funds are now running a hybrid model where they are investing not only in public markets but also late-stage startups. While this is happening, retail brokers are diversifying their portfolios by investing in small private companies. What is driving this recent phenomenon? Listed below are the key factors that help to shape a new ecosystem of the private investment market.

Timothy Yang, Director of Business Development at DealIndex, says: “The push towards more information transparency, globalization and evolving private company structures mean that the fundamentals of the private market are constantly changing. It is certain that the rise of private investment is here to stay and will increasingly become more open to investors globally.” Private investment no longer is just within the exclusive domain of traditional private equity and venture capital firms. This is an edited version of an article originally published at http://wp.me/p5mFcE-38 by DealIndex. You are free to re-edit and re-post it under Creative Commons Attribution 3.0 License terms by giving credit to the author with a link to www.startupcommons.org and the original post.

Last week the German Government approved a regulation to protect small investors investing through online securities crowdfunding portals. The law drafted in 2014 was seen by many industry players as way too restrictive, potentially able to kill the growing German market of digital investments. For the relief of many stakeholders, the approved version is softer than the original one, having eliminated a couple of the most stringent restrictions. The regulation on online investing was on the table of Angela Merkel for a while. The first draft received many criticisms from the German crowdfunding ecosystem. In fact, the proposed rules included points which created unnecessary obstacles to online investing. For example, there was a rule that investors have to send an investment information sheet via mail and sign it manually. The approved version of the Small Investors Protection Bill includes a reviewed Crowdinvesting Exemption, which leaves out previous points regarding mailing of an investment information sheet and signature. It also increases the cap under which fundraisers do not need to produce a long prospectus: from €1million to €2.5 million. Furthermore, the investment limit for retail investors has been increased up to €10,000 if they can provide a proof that their assets or income are at a sufficient level to bear the risk of loss. Otherwise, it remains at €1,000. Soon we will see if this crowdinvesting regulation has struck the right balance and will help digital investing to flourish in the country. Reference: Nienaber, M. (2015). Germany approves crowdfunding rules to protect small investors. Reuters. 23 April. This is an edited version of a post originally posted at http://www.crowdvalley.com/news/germany-adopts-regulation-for-online-investing by Irene Tordera. You are free to re-edit and repost this in your own blog or other use under Creative Commons Attribution 3.0 License terms by giving credit with a link to www.startupcommons.org and the original post. Photo credit: Got Credit, http://www.gotcredit.com/. The photo was originally published on Flickr. It has been used to illustrate this text under Creative Commons Attribution 2.0 License terms. No changes have been made.

Singapore has been ranked as one of the best places for startups in Asia and around the world. It is well-positioned geographically, offers great infrastructure and logistics, as well as diverse, well-educated talent pool. Singapore is strategically located within hours from fast growing economies such as China and India and consistently attracts the best and brightest minds from different parts of the world. Venture funding, government support and developed startup ecosystem, together with features mentioned above makes Singapore an attractive place for entrepreneurs. more than 50. Let’s have a closer look at some incubators and accelerators in Singapore.

1. Golden Gate Ventures It is an early stage incubator helping internet startups build and launch successful companies across Southeast Asia. Golden Gates Venture’s founding partners share a rich background building successful Silicon Valley startups and managing investments in Silicon Valley and Asia. What is interesting: For startups at their Ideation and Concepting stages, Golden Gate Venture offers 100 Day Bootcamp Program, which is run once or twice per year. Since March 2012, Golden Gate Ventures has been accredited as a Technology Incubation Scheme (TIS) incubator by Singapore’s National Research Foundation. Results: Last year Golden Gate Ventures invested $10 million into startups in their first year. The portfolio includes RedMart.com (online grocery), Coda Payments (mobile payments), and Nitrous.io (web dev tools in the cloud). 2. The Joyful Frog Digital Incubator The Joyful Frog Digital Incubator is recognized as the most successful in Southeast Asia. It is also the oldest among the pack, which should highlight why the company has the most comprehensive, systematic and consistent programs for a wide range of startup companies. The Joyful Frog Digital Incubator piloted its startup accelerator programme in 2012. Over two years JFDI startups raised over $ 7.2 million in seed funding. What is interesting: consistently achieving 60%+ success taking startups to investment in 100 days. Typical startups raise around $ 550 000. In exchange for a minority stake every team, who has been selected for the program is offered a package including cash investment, mentoring, working space. Results: 38 startups have graduated, out of those 34 are still active. 3. Jungle Ventures Jungle makes seed to early Series A investments across Asia Pacific and also operates an early stage accelerator in Singapore. Founded in 2011 with focus is on early stage investments into Singapore, India, South East Asia and other regional hotbeds of innovation. What is interesting: Startups through the seed fund accelerator can look to get: S$50-500K in startup funding, co-investment by 500 Startups, a leading SV based fund, and more. Results: Current portfolio companies include micro-lending platform Milaap, mobile commerce app ShopSpot, and vacations rental site Travelmob which was acquired by Homeaway last year. So far 27 investments has been made, 24 startups still active and 3 successful exits.  Start-up ecosystems around the world are scaling new heights. Startups raising millions of dollars and numbers are growing. Here are 9 things to consider before raising funds for a start-up: 1. Never have more than 3 founders Too many cooks spoil the broth. Having 2-3 founders is an ideal choice. In case you need more experts, you can always hire them. In rare cases more than 3 founders stick together; if the number is more, ultimately, it boils down to 2 or 3. Having one founder is also a bad option. Having different perspectives and divided risks is always a favourable position to be in. 2. Analyse the market; the idea may be good, but the market may not be ready It is primarily important to interpret the existing market scenario in terms of your idea. Broadcasting your idea at the right time is where most of the startups fail. Therefore, first analyse the market and then take a call. If needed keep patience and wait for the market to develop according to your perspective. 3. Pick the right mentors Having the right mentors to guide you and help you manage risk is a blessing in disguise. Even though there are no hard-and-fast rules of choosing a mentor, make sure that your frequency and belief matches. A mentor should believe in your idea and ambition, as a result, making your journey easy and a learning experience. 4. Maintain your accounts A list of expenses of the previous and the upcoming months should always be maintained. This helps you keep track of where the money is going and how much money will be needed. As a result, while going to an investor, you can always show them the accounts and logistically present the amount of funds required. 5. Ensure financial stability in your personal life Giving up an existing job to start a venture is quite a challenging task. Knowing well that the risk may or may not bear fruit, it is of utmost importance to ensure that all the debts are cleared. Also, make sure that the medical insurance, family savings and credit cards are in place. Alongside, keep a minimum runway of 9-12 months. Once all the basic things are taken care of, it will become easier for the risk taker to concentrate on his venture. 6. Family money Keeping personal reputation at stake is riskier. Considering that most startups fail, ideally, family money should not be more that 5-10% of the total investment. 7. Consider funds as a bonus Planning a startup on the basis of bootstrapping is considered to be an ideal one. This helps you concentrate on your business completely rather than hunting for an investor. Also, this will help you control the company completely without any pressure from outside investors. 8. Go to 3-4 investors see what they are asking for Meeting an investor can be a learning experience. Listen to all the questions he asks for after you give your presentation and make a note. Remember, those are the areas the investor is not comfortable with. The more you meet investors, the more you will be able to understand the loop holes in your venture. 9. When a startup does not work, it is good to accept it The bitter truth is that approximately 80-90% of start-ups fail. It is good to make your call and move on if things don’t fall into place. Of course, this should be the last resort but as a risk taker, remember that at times you need to let things go. ___________________________________________________________________________________________ This is an edited version of a post originally posted at yourstory.com, by Richa Maheshwari (reporter from Yourstory.com). You are free to re-edit and repost this in your own blog or other use under Creative Commons Attribution 3.0 License terms, by giving credit with a link to www.startupcommons.org and the original post. Make no mistake about it. Silicon Valley is expensive. Actually, it’s very expensive. But if you’ve ever spent any time in the Valley then you already knew that. For those on the outside, then you can believe that rumors surrounding Silicon Valley’s pricey cost of living are true.

Should you move your business to Silicon Valley? Before you make that decision, here are a few things you should keep in mind? But, just how expensive is Silicon Valley really? Compared to the rest of the country, the cost of living is 87% higher in the Valley than any other American city. When it comes to housing, Silicon Valley is also the most expensive in the U.S. In fact, based on a survey conducted by Coldwell Bankers in its “Luxury Market Report 2014,” Woodside, CA is the nation’s top luxury market. Woodside wasn’t the only town located in Silicon Valley to crack the top five. Portola Valley was third, with Hillsborough coming in at number four. So, if you wanted to relocate to Woodside, expect to spend $949,000 on a two bedroom house with one bathroom and a fireplace – this for the record was the cheapest listed house in Woodside. Trulia, however, found that the average listing price for homes in Atherton at $9,347,107, which could make it the most expensive city in the country. But what’s a couple million dollars when you’re living in the same area as the guys who founded Google, Larry Ellison, Mark Zuckerberg, George Lucas and Paul Allen? In case you were wondering, there are 71 billionaires who call the Bay Area home, so of course it’s going to be expensive. So what if you’re not a billionaire? Let’s say you’re just you’re a teacher or even an engineer, what’s the price range? The median price for a home is $550,000 in the whole bay area. If you’re looking at San Francisco, it’s around $1.1 Million. And rent? You’re looking at around $3,000 a month for a two-bedroom apartment, which is 76% more than the national average. I personally pay $2,700 a month for my one bedroom in Palo Alto. I had to consider this before I moved my startup to Silicon Valley. To put it another way, if you have a family of four, you would need $90,000 a year to cover rent, food, transportation and childcare. To be more upfront, Silicon Valley is the 7th least affordable housing market for middle class families, San Francisco captured the top spot. Of course, the housing situation isn’t the only major cost in the Silicon Valley. Living in California also means that if you make over $46,776 a year, the state is going to hit you with a 9.3% income tax. Speaking of taxes, whenever you go out and do some shopping, just remember that California has the second highest state and local sales tax rates at 9.08%. Even Hawaii has more favorable sales tax rate at 4.35%. If you look at the ten most expensive cities in regard to sales tax, Fremont and San Francisco are included. As for basic necessities. Silicon Valley is 62% higher than the national average. And gas prices? Both San Jose and San Francisco are included in the ten most expensive cities for gas at over $4 per gallon. Is any of this that big of a concern when you reside in one of the highest paying areas in the country? (Web developers earn $25,000 more than the national average and customer service representatives and lawyers also do well here). Well, it should. Despite Silicon Valley having a reputation for having a higher median income (it was $60,000 in 1993 compared to the $30,000 elsewhere in the country) it’s still a concern if weighing your options on whether or not to live in Silicon Valley. For example, if you made $92,300 a year in the Valley, you would need $74,800 to live that same exact lifestyle in New York City. That’s not saying that you should relocate or never move to the Valley. It’s just bringing up a comparison to give you a better understanding of how pricey, it is to live in Silicon Valley. If you already reside in the Valley, then you already know how expensive it is for housing, gas, food, etc. And hopefully you’ve been fortunate enough to make enough in your salary that you can enjoy the weather and everything else that Silicon Valley has to offer. However, if you’re looking to move to this area because you think it’s magical and can help make your startup a success, you may want to consider other options if money is tight. While it’s an incredible place to work and play, the Valley is really, really expensive. _____________________________________________________________________________________ This is an edited version of a post originally posted at yourstory.com, by John Rampton (President at Adogy), an entrepreneur, full-time computer nerd and startup expert. You are free to re-edit and repost this in your own blog or other use under Creative Commons Attribution 3.0 License terms, by giving credit with a link to www.startupcommons.org and the original post. It is very typical to measure mature of startups ecosystems in terms of new startups, growing startups, investors, investments, exits, etc. and it makes sense as cities use these statistics in the best possible way to communicate their economic growth at high level and to attract other relevant people, investors, big companies, more entrepreneurs and other stakeholders. These indicators are however the result of many smaller activities present in a startup ecosystem that contribute to these higher level results - as any startup ecosystem is the sum of multiple variables of an unbalanced equation inherent to the interactions of the startup ecosystem itself. So, as you can figure out, you need much information to talk about matureness of startups ecosystems. But most of all, you need a good understanding and analysis of your startup ecosystem at different levels and mapping it usually is a good starting point to set up new strategies and achieve a better economic development. But the thing is that properly mapping a startup ecosystem is more than just to create a good map to show who is who in your city or region. It is crucial to work at different levels and in more detail:

We truly believe everyone should work on this model, as it makes the investments to growth and innovation truly visible and measurable - as only the things that can be measured can be improved. And the faster the feedback loop, the faster things can be improved. Actually we are working with this model with few key cities like Helsinki at ecosystem level and even more broadly with independent organizations and we are clearly seeing that it is possible to build a vibrant startup ecosystem in a city in three to five years, what is half or less, compared to known average. Future entrepreneurs and current startups deserve this new scenario that we at Startup Commons are creating and we encourage others to contribute and develop innovation, better, faster and with less resources. Are you a consultant or an entrepreneur? - Learn more about Growth Academy Online Training & Certification Programs Download our startup booklet and watch our videos to learn more about our framework to help startups to grow without "reinventing the wheel" and without wasting lot of time trying to connect the dots. The framework is based on the startup development phases and aims to remove the highest universal risks on the startup journey. This is an originally posted by Óscar Ramírez, CEO Startup Commons. You are free to re-edit and repost this in your own blog or other use under Creative Commons Attribution 3.0 License terms, by giving credit with a link to www.startupcommons.org and the original post

The 12th annual Innovation Africa Digital Summit (IADS) held recently in Gambia in western Africa highlighted the growth of ICT infrastructure and innovative services in the region. Gambia has the highest teledensity in Africa, and despite its small size, punches above its weight when it comes to ambitions and targets. Industry and government agencies indicated at the conference that the country plans to become an ICT hub in the next 3-5 years. According to a recent Media Monitor International report, Gambia displays a great enthusiasm towards entrepreneurship, as reflected in its investment in youth, competitions and awards for entrepreneurs. The Children and Community Initiative for Development (CAID) and Africa Youth Panel (AYP) have rolled out a range of capacity building initiatives for youth. The Gambia Investment Export and Promotion Agency (GIEPA) conducts an annual Business Plan Competition for MSMEs. The ministry of Trade, Industry, Regional Integration and Employment has also launched an innovation grant as part of the Social Development Fund, to commercialise local projects. An estimated two-thirds of Gambia’s economy is powered by MSMEs. MNCs such as Intel and Microsoft have announced initiatives to invest in local startups in Africa. The companies are promoting local app development as well, considering that much of Africa is a ‘mobile first’ economy when it comes to ICTs. Gambian ICT entrepreneurs such as Muhammed Jah have been covered prominently in local and international media such as the BBC. Jah is the founder of QuantumNet, an ICT company with over 300 employees, and was recently estimated to worth around $156 million. Momodou Drammeh, enterprise director at GIEPA, explains that Gambia is one of the safest countries in Africa, a melting pot of eight different ethnic groups, competitive in its labour force, stable in economy, and speaks English as an official language. Gambia’s membership to the Economic Community of West African States (ECOWAS) trading bloc ensures market access to over 300 million people. International players are also active in Gambia’s entrepreneur movement. Africa Startup, based out of Norway, has launched two projects in Gambia: MyFarm (a one-hectare farm-based educational centre focusing on ‘seed to business’ agri-activities) and MyFarm Produce (to promote better packaging of agricultural produce). Gambia is already a cultural hub with a unique blend of local and international music, with a range of fresh talent also using digital media for music discovery and promotion. Notable musicians include Jaliba Kuyateh, Foday Musa Suso, Tabou Diop, Jalimadi, Pa Bobo Jobarteh and The Kaira Band, to name just a few Read the whole article on yourstory.com This is an edited version of an post originally posted at yourstory.com, by Madanmohan Rao. You are free to re-edit and repost this in your own blog or other use under Creative Commons Attribution 3.0 License terms, by giving credit with a link to www.startupcommons.org and the original post.

Any startup ecosystem in the world needs a constant flow of people coming and going in order to refresh the ecosystem with new ideas, startups, investors, people who upgrade their skills, multiple resources, etc. That’s key to keep it alive.

Alex Farcet seems to have pretty clear this flavour through StartupBootCamp accelerator, focused on Europe not only fostering entrepreneurship and supporting global startups but also building a new breed of angel investor with AngelsBootCamp, a two-day workshop to train executives, entrepreneurs and finance professionals in interesting topics like due diligence, legal trends, portfolio management or investments with a practical approach, interacting with experienced investors. In a nutshell, the first great approach that you need if you feel attracted by startup world but you have no experience, or if you are a successful entrepreneur with some money in the bank and watching and mentoring projects and need the right skills to start support them from the investment perspective. The first AngelsBootcamp took place last year in Berlin on 7-8 June and now StartupBootCamps has just launched a new AngelsBootCamp again in Berlin on 17-18 March. From Startup Commons perspective, we encourage and support this kind of events that aim to build a better scenario for entrepreneurs in Europe and aligned with our mission to develop a global startup ecosystem more accessible, transparent and efficient for all stakeholders in the startup ecosystems. |

Supporting startup ecosystem development, from entrepreneurship education, to consulting to digital infrastructure for connecting, measuring and international benchmarking.

Subscribe for updates

Startup ecosystem development updates with news, tips and case studies from cities around the world. Join Us?Are you interested to join our global venture to help develop startup ecosystems around the world?

Learn more... Archives

December 2023

Categories

All

|

- Startup Commons

- Business Creators

-

Support Providers

- About Support Providers

- Learn About Startup Ecosystem

- Startup Development Phases

- Providing Support Functions

- Innovation Entrepreneurship Education

- Innovation Entrepreneurship Curriculum

- Growth Academy eLearning Platform

- Certified Trainers

- Become Growth Academy Provider In Your Ecosystem

- Growth Academy Training On-Site By Startup Commons

-

Ecosystem Development

- About Ecosystem Developers

- What Is Startup Ecosystem

- Ecosystem Development

- Ecosystem Development Academy eLearning Platform

- Subscribe to Support Membership

- Ecosystem Operators

- Development Funding

- For Development Financiers

- Startup Ecosystem Maturity

- Case Studies

- Submit Marketplace App Challenge

- Become Ecosystem Operator

- Digital Transformation

- Contact Us

- Startup Commons

- Business Creators

-

Support Providers

- About Support Providers

- Learn About Startup Ecosystem

- Startup Development Phases

- Providing Support Functions

- Innovation Entrepreneurship Education

- Innovation Entrepreneurship Curriculum

- Growth Academy eLearning Platform

- Certified Trainers

- Become Growth Academy Provider In Your Ecosystem

- Growth Academy Training On-Site By Startup Commons

-

Ecosystem Development

- About Ecosystem Developers

- What Is Startup Ecosystem

- Ecosystem Development

- Ecosystem Development Academy eLearning Platform

- Subscribe to Support Membership

- Ecosystem Operators

- Development Funding

- For Development Financiers

- Startup Ecosystem Maturity

- Case Studies

- Submit Marketplace App Challenge

- Become Ecosystem Operator

- Digital Transformation

- Contact Us

RSS Feed

RSS Feed