|

Mobile World Congress, Barcelona, February 26, 2018 - Startup Commons announces global ecosystem applications marketplace with open call for app developers around the world building applications, SaaS services or platforms focused on startups business creation, managing support services for startups or managing & coordinating ecosystem development, and looking to expand to more ecosystems.

“As part of our work with various startup ecosystems around the world, we came across growing interest in applications used in other regions, to learn from these applications and developers for own local ecosystem needs.” - says Oscar Ramirez, CEO, Startup Commons Global. “We know there are number of great applications and online services being developed and operated in these ecosystems. There are also many exceptional and dedicated developers working on their digital solutions, having great understanding and perspective of ecosystem developers challenges, understanding business creators or support providers needs at various startup development phases. As a global ecosystem facilitators with a member base of over 30 000 ecosystem actors around the world, we want to help good applications scale to new markets with new user & customers, and help ecosystems key actors to find best connected applications to accelerate their progress and ecosystem development.” Applications Marketplace is a natural extension of Startup Commons EcosystemOS - a serverless cloud architecture for developers, including ecosystem level user accounts and ecosystem API's, with global standards and documentation for user data portability, API connections, data models, data sharing principles. Open a call for first batch of ten best digital solutions:

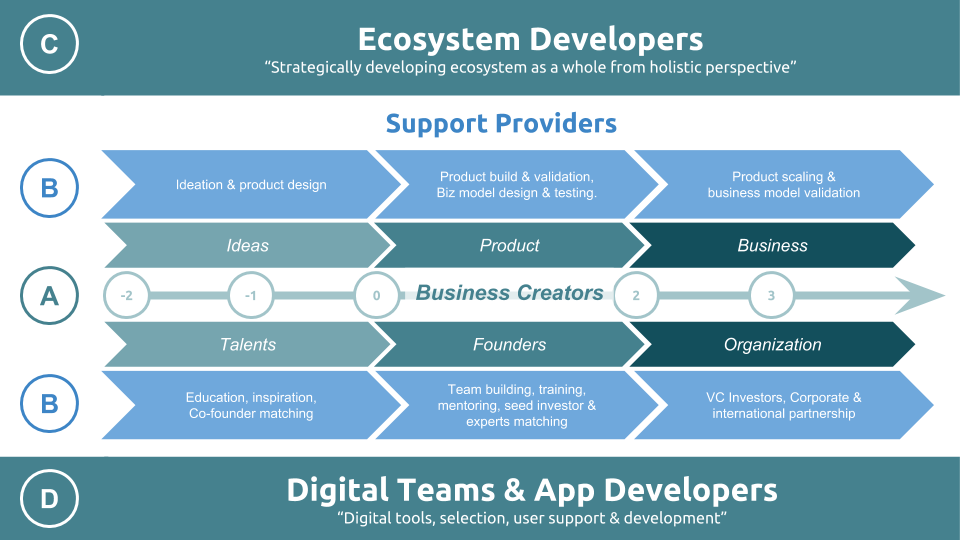

Apply to join Startup Commons Marketplace www.StartupCommons.org/applications-marketplace.html About EcosystemOS www.EcosystemOS.com Contact Details Oscar Ramirez, CEO Phone: +34 656 180 880 Email: [email protected] Web: www.startupcommons.org About Startup Commons Startup Commons is dedicated to digitizing and connecting startup ecosystems globally to scale entrepreneurship, innovation and business creation around the world, by providing digital connectivity and solutions to enable data-driven economic development and policy making for local ecosystems. This post is for anyone taking part with entrepreneurship, innovation or startup ecosystem development at any level. As part of iteratively improving our Startup Ecosystem development framework, Startup Commons has created a new approach to describe key actor segments in startup ecosystems. Our website is now also divided between these four segments: business creators, support providers, ecosystem developers, digital teams - to help you find the most relevant content for each segment. Although there are overlaps between the various roles that people play, we have learned that it is valuable for ecosystem actors to identify the roles that they play at any given time to enhance the effectiveness of their interactions within the broader ecosystem. A simple example is our Growth Academy's startup entrepreneurship education curriculum that has at least two relevant segments and perspectives;

From Ecosystem Developers' perspectives, they should be aware of and evaluate the availability of such or similar curriculum in their ecosystem and how it is performing ie. how is it made available, offline and/or digital format? how often is it run? What is the number of participants? What is the feedback for quality/value of the curriculum for participants? What is the impact for ecosystem top level KPI’s (like number of new businesses created, improved success rate, faster growth, etc.)? Step by step, we will be adding these segments into all of our materials and applying them to all of our communications going forward. This should not only help you find the most relevant content on our website but also help you to understand the perspective from which any items can be perceived. Key Ecosystem Roles in more detailPlease take some time to understand these roles since they will help you make sense of the jobs that people do within your ecosystem and identify which roles need to be filled. A. Business Creators Business Creators are people who as their primary role develop new companies. They include founders, entrepreneurs, key team members, investors and board members. Ie. founders & other equity holders. In this segment, there are naturally category specific subroles at the strategy and operative levels, as well as for specific skills or company operations specific roles. From finance to management, to designers, developers, sales etc. Business Creators perspective, role, and focus is in one company (or depending on their more specific role to only few companies) at a time for longer period of time in logical and balanced manner over longer period of time; especially in case of being a founder, early team member, or angel investor. It is also quite common that people who are founders, later on become "serial entrepreneurs" and Business Creators in more flexible or more systematic ways. Ie. more flexible would be becoming an advisor board member, mentor etc. and more systematic would be to become an angel investor, VC, create own accelerator etc. Many Business Creators also work together with support providers as mentors, advisors board members etc. to a) share their expertise for support organizations needs and/or b) to build relationships to get "deal flow" of new entrepreneurs and early startups with which to work. As they become more involved, they will acquire more channels for "deal flow" and reputation building. At the same time, involvement in the ecosystem is a lot about just "giving back" as well. B. Support providers Support providers are all the public and private support function providers catering support services directly for venture building, mainly free or for nominal fees (subsidized by government or other bigger organizations). The support providers are available in the ecosystem, and providing the support function is their primary role. At the same time, some of them also have overlapping roles in venture building (investors, board members, accelerators etc.) or in ecosystem development (universities, incubators, banks etc.). Additionally, in this category, there are naturally category specific subroles at the strategy and operative levels, as well as for specific skills or organization operations specific roles. From finance to management, to designers, developers, sales etc. depending on the support function. Support providers' jobs are to cater for specific need of Business Creators at a specific stage of the ventures development and provide support to that need effectively. As such their support for venture may be very effective, deep and valuable, but it’s meant to serve a high volume of ventures and only for relatively short time (to remove the need and help venture move forward). Most support service organization primary operative people do not typically possess an entrepreneurial background, or they may have some experience from long ago, without big success (there are naturally expectations as well). They learn from their partner mentors but also from startups they help, as well as many many trainings, events etc. that they organize, listen, and learn. While support providers may not have first hand experience, they have a lot of "holistic" understanding and can be very helpful to new entrepreneurs. They also gain unique perspectives on startups because they see a lot of them, gaining exposure to many ideas and types of people. They develop a strong and interesting skillset, especially if they cater to various different support functions at different development stages over time. These roles also help to create necessary talent for ecosystems, and some support providers eventually join startup teams or become founders or other Business Creators themselves. The key difference in perspective between Business Creators and Support function providers is that Business Creators focus on one, or a maximum of a few, ventures at a time for longer periods of time, and they possess direct stakes (equity positions) in their companies' success, gradually developing them through various development phases. On the other hand, support function providers mainly focus on specific needs of business creation, typically at a specific stage of the venture's life, without having direct stake in the outcome. This gives them neutral and non-biased positions. It also means that support function providers cater to higher volumes of ventures in shorter periods of time, focusing on solving specific needs at hand. In earlier stages of development, the volume of ventures is higher, and the hands-on interaction period is shorter. Additionally, in the earlier stages, support providers help to partially fill in for certain types of roles and provide external perspectives in the short term before the team have other “more built-in” external/strategy perspective business creators committed (ie. board members, advisors, investors). C. Ecosystem Developers Ecosystem Developers are focused on startup ecosystem orchestration and are made of policy makers and ecosystem developer individuals whose primarily interest and role is to develop the ecosystem as a whole. The key focus of ecosystem developers is not directly in either venture building or providing a specific support function but rather to focus on developing and growing the ecosystem from these components in indirect ways. Ecosystem developers directly support operative support providers and indirectly support business creators (policy, funding instruments, funding for support functions etc.). To be able to develop the ecosystem, ecosystem developers need to create and maintaining holistic pictures of the majority of businesses being created and the related “collective support providers funnel” composed from individual support functions available for the Business Creators needs - and to manage the balance between these two main segments at various development stages, verticals and levels (availability balance between need & supply at any given time). They also manage the effective quality and efficiency of these services. Where there are gaps, bottlenecks, unmet needs, imbalance, inefficiency or obstacles, - new ecosystem development initiatives should be created. However, before creating new initiatives, a holistic view of existing initiatives and their statuses should be collected. While there may be multiple organizations running development projects independently or collectively, ecosystem developers' roles are to coordinate and maintain lists of these ecosystem development initiatives and projects in logical manners and manage up-to-date information about their priorities and statuses. D. Digital teams & Applications Each of the other segments have some different connections with the digital side or even have their own digital team members, ie applications to support operative processes like CRM, newsletters etc., websites for publishing information, online services & tools like communities, or funding applications etc. and people making selections for these tools and providing supporting for users. This fourth segment is divided to two parts: (1)those who select the applications to be used and provide user support for those within their organization (digital teams) and (2)tools being used (applications) & developers who actually create new ones or develop them. Digital skills are in high demand and short supply - Digital teams are responsible for developing, testing, and implementing a set strategy to reach, engage and serve target audiences through digital channels and applications like web, mobile, and social. While other groups may create the strategy, draft the messaging, etc. a digital team works hand-in-hand with communication and service team leaders to create the digital strategy, most often reporting through the CEO or COO. Digital teams are also often responsible for providing guidelines and tracking for KPI's and implementing cross-channel analytics, as well as surfacing relevant emerging trends and audience behavior. Digital teams collaborate heavily with application people, who are responsible for critical technology infrastructure and associated applications. Naturally within these segments, there are also related categories like designers, frontend and backend developers, project managers, support people etc. The main reason to separate digital teams and applications into its own segment is that while they are part of any of the other segments they can be considered to focus only on a) what applications are needed, b) what will be used (including in some cases to self develop suitable application) and c) how to use the selected applications to support the main functions. To help make digital transformation in economic development for more data-driven policy making, learn how a ecosystem level digital team setup would look like. If you found this post valuable in your ecosystem development activities, please consider sharing it with your network. Download related presentation: Ecosystem Key Actor Segments About Ecosystem DevelopmentWe know startup ecosystem development and understand it is a multilayered, complex and challenging long term endeavor. However, this is where economic development is competing now globally, and the only way to be competitive is to attack the challenge head on and keep going.

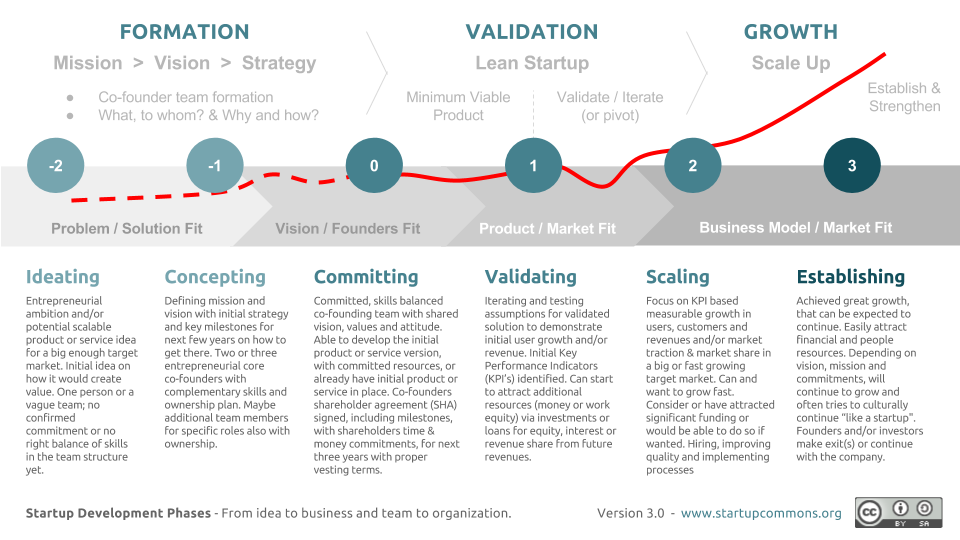

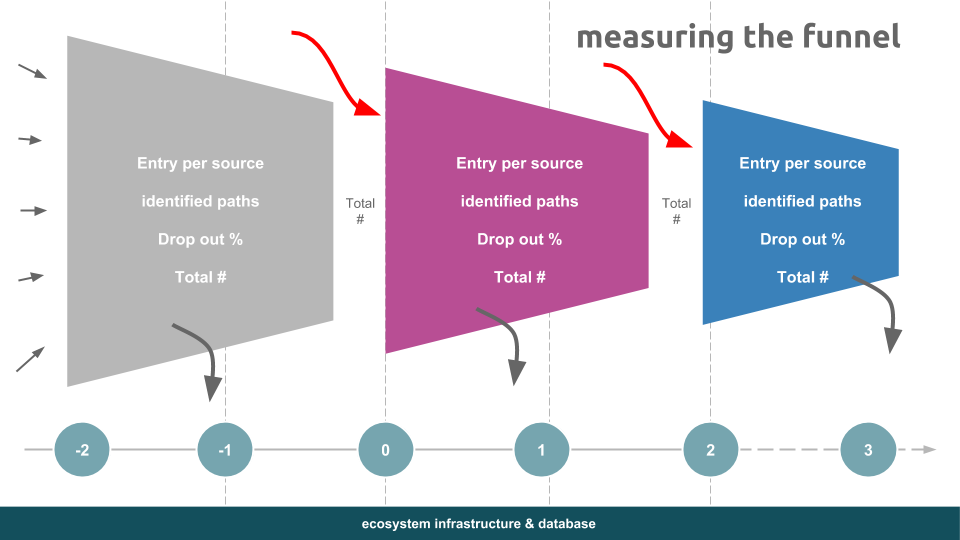

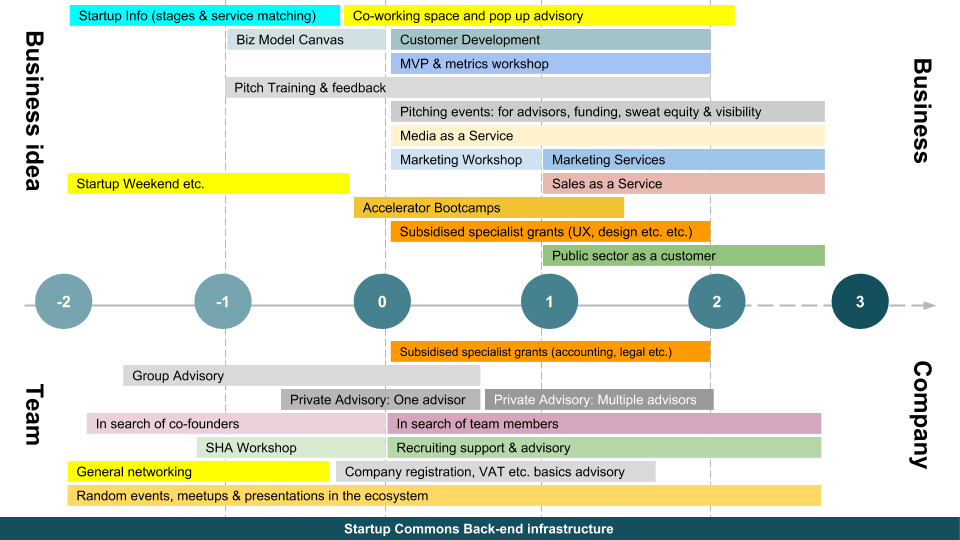

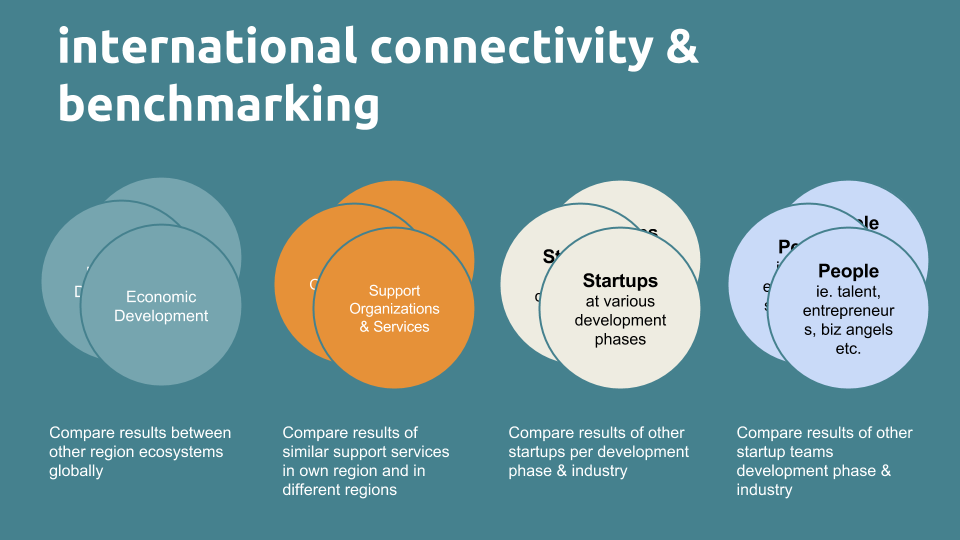

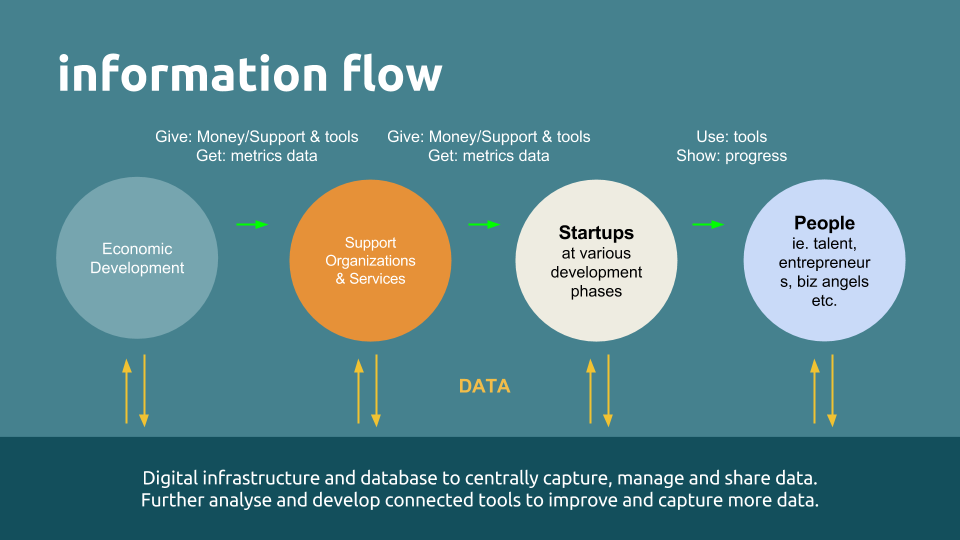

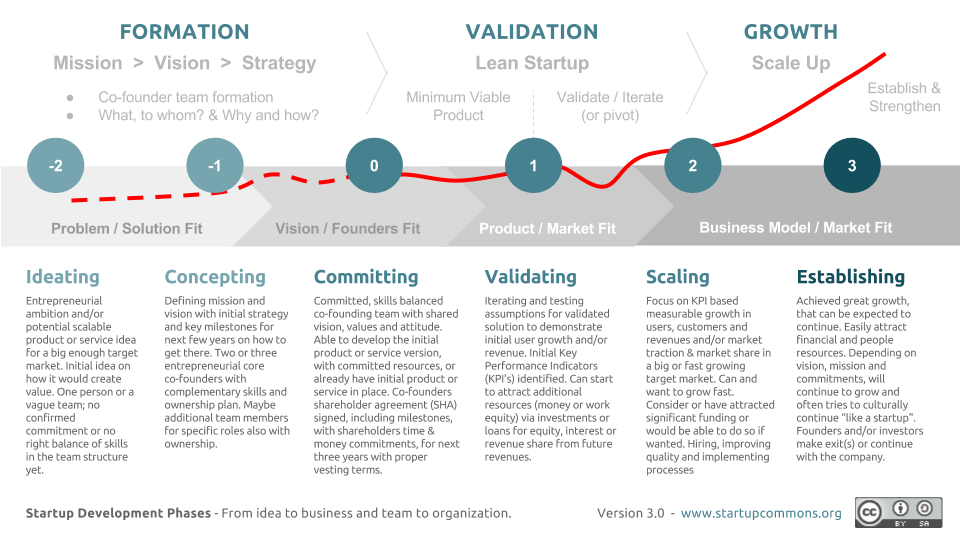

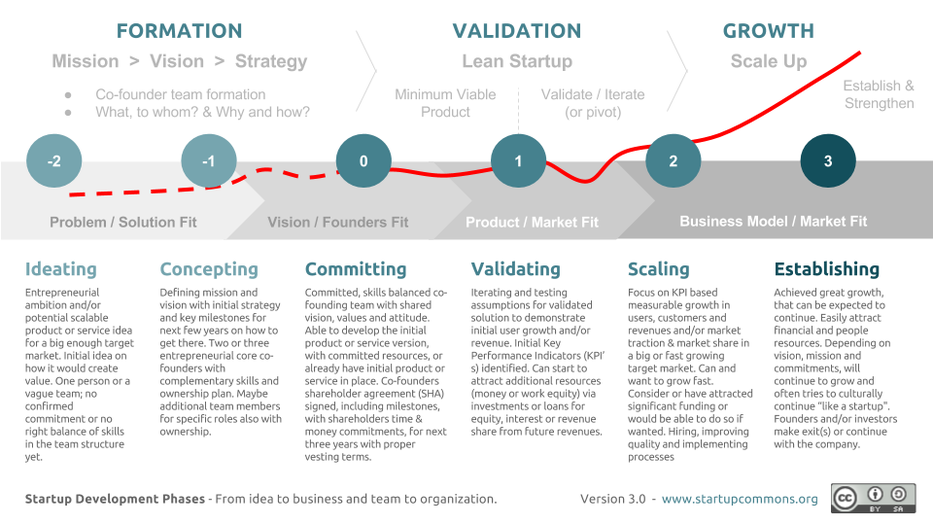

This is a small summary snapshot of our more complete Startup Ecosystem development framework and materials. Get in touch to start scheduling a workshop or consulting project to take your ecosystem to next level. Key performance indicators (KPI’s) play a vital role in startup ecosystem financing. In addition to helping policy developers visualize and benchmark growth, KPI’s enable economic development organizations and support providers to make highly informed financial decisions. Does your organization want to learn how to save money, manage risk, and stimulate economic growth? It’s time to learn how to use KPI’s in startup ecosystem financing. Startup Development Phases Before implementing KPI’s, you must first understand startup development phases. Startups go through three phases: formation, validation, growth. During each phase, startups require different services, which is where support providers can assist. Specific KPI’s are relevant to each phase. For example, the number of new participants may be relevant during the formation phase, and the number of actions to validate assumptions may be a useful metric for the validation phase. Startup Growth Funnel As startups transition from one phase to the next, a certain percentage will fail and drop out of the process. Others will graduate from various programs and enter new ones as they move to more advanced phases. Entry sources, dropout rates, and numbers of participants are helpful KPI’s to track if you want to gather a holistic picture of the ecosystem and understand what support services, as well as ecosystem entry points, are the most promising. However, these KPI’s are virtually useless to ecosystem developers, unless they can act on them. It is essential that ecosystem developers, such as economic development organizations, tie their resource allocations to KPI’s. How can ecosystem developers accomplish this? Ecosystem mapping is the best place to start. Ecosystem Mapping Using Startup Commons’ Ecosystem Mapping Application, ecosystem developers can visualize support services in relation to startup development phases. When it is combined with KPI’s, the Ecosystem Mapping Application paints a clear picture of which support services are the most effective, and it highlights gaps in services that need to be filled. Ecosystem developers should use KPI’s when deciding how to allocate financial resources to support providers. With their funding contingent on KPI’s, support providers should allocate financial and educational resources to startups, based on the startups’ KPI’s. Let’s use an example. Suppose Accelerator A and Accelerator B both serve startups in the validation phase. However, Accelerator B has a 50% higher dropout rate for startups moving into the growth phase. Furthermore, startups in Accelerator B take 75% less actions to validate assumptions than startups in Accelerator A, and all other factors are constant. If ecosystem developers tie the accelerators’ funding to their dropout rates, then Accelerator B will have a high incentive to move more startups into the growth phase. Accelerator B can accomplish this by investing more financial and educational resources into helping its startups take actions to validate assumptions. Although scenarios are never usually this simple, the example illustrates how KPI’s can help ecosystem developers and support providers make better financial decisions, which will ultimately improve ecosystem outcomes. Rather than making blind investments, KPI’s enable financiers to structure agreements where funding is contingent on outcomes and incentives are properly aligned. Measuring KPI’s Startup Commons’ KPI Data Dashboard makes it easy for ecosystem developers to monitor and measure KPI’s throughout their ecosystems. If you are interested in tracking KPI’s or mapping your ecosystem, please reach out to us through the form below. We can also teach you more advanced financial engineering and hedging strategies to improve your startup ecosystem financing. What would you do for data? Would you pay money, provide services, or barter with tools? How do different organizations exchange data in startup ecosystems? In the modern era, data is becoming an exceedingly precious commodity. A digital transformation in economic development is taking place as data-driven policy development begins to shape the world. Startup ecosystem analytics will play a vital role in this digital transformation, fueling data-driven policy development in the startup space. Startup Commons is working to help startup ecosystem developers adapt to this digital transformation by offering GovTech for economic development, specifically startup ecosystems. Our Digital Ecosystem Applications are designed to help ecosystem developers, support organizations, and startups exchange data in startup ecosystems. Since our tools are designed to facilitate data exchange, we would like to share with you how the transactions work. As illustrated in the graphics, information flows between organizations and the digital infrastructure, which is centrally operated by the startup ecosystem development team. In order to make the data flow, larger entities typically provide money, support, and tools to smaller entities. As organizations share real data about their performance and developments, they can receive more money, support, and tools. This creates a positive feedback loop of information flow. Once organizations begin sharing data between others, they can start comparing results on regional, national, and global levels. Our KPI Data Dashboard, a form of GovTech for economic development, enables government agencies policy makers and NGO’s to share and compare startup ecosystem statistical data with other regions to benchmark economic growth. Service providers can also use various Digital Ecosystem Applications to compare outcomes in the context of startup ecosystem analytics. Business creators and startup teams can also compare their data, as well as business performance, with other startups in similar development phases and industries. The above graphic explains the various startup development phases. Startup teams can get started with visualizing and benchmarking their progress with tools like Business Plan Tool and others, provided in their ecosystem.

With broader understanding how to exchange data in startup ecosystems, we encourage you to reach out to us, to learn more about our Digital Ecosystem Applications. We help you connect, visualize, and benchmark your startup ecosystem, Contact us today. Entrepreneurship education differs from other disciplines. When you train students to become entrepreneurs, you are teaching people to create their own jobs, serve unmet needs, and change the way society functions. Essentially, you are teaching them how to navigate uncharted waters. Traditional business schools, as well as other vocational programs, use clear metrics to define student success. These metrics include how many students get jobs and how much they earn. Benchmarking entrepreneurship education is a much more difficult task. How can universities and entrepreneurship education programs measure student outcomes in uncharted waters? The LEO-I Model According to “Entrepreneurship Education Comes of Age on Campus,” a 2013 Kauffman report, Arizona State University has developed an innovative model to measure entrepreneurship education outcomes. The LEO-I model consists of four dimensions: Landscape, Engagements, Output, Impact. Landscape: What courses, clubs, services, etc. does the university offer to train students in entrepreneurship? Engagements: How many students, faculty, and staff are participating in the university’s entrepreneurship offerings? How many are starting? How many are finishing? Output: How many ventures are students starting? How much funding have these ventures received? How many patents are being created? (Output covers quantifiable outcomes.) Impact: How are the university’s entrepreneurship education programs changing the world, as well as students’ lives? Are student ventures sustainable? (Impact is much harder to measure than output.) Problems with the LEO-I Model The LEO-I model provides a strong starting point for benchmarking entrepreneurship education, but it lacks in several areas.

Solutions to LEO-I Model Problems Here is the overview of solutions to the problems that occur within the LEO-I model:

Now, let us explore each solution in greater detail. Benchmarking Entrepreneurship Education at the Ecosystem Level Universities are clearly not the only institutions educating entrepreneurs. Formal training programs, such as accelerators and workshops, help entrepreneurs build key skills, grow their startups, and raise investment capital. Additionally, mentors, advisors, and collaborators provide informal training and support for entrepreneurs. In a sense, startup ecosystems are like giant universities, offering a wide selection of entrepreneurship services. However, it is much easier for universities to keep track of their entrepreneurship offerings than startup ecosystems since universities are more centralized than startup ecosystems. In order for data-driven economic development to occur within startup ecosystems, policy makers and ecosystem developers need mechanisms to apply the LEO-I model to their startup ecosystems. This is where Startup Commons can help. Our Ecosystem Mapping Application and Startup Ecosystem Portal enable ecosystem developers to understand the landscapes of their entire ecosystems. By applying our Ecosystem Development Framework, which is based on our Startup Development Phases, ecosystem developers can easily measure engagements and outcomes for their entire ecosystem, as well as specific entrepreneurship education programs. Applying KPI’s to Measure Impact

Using KPI's to measure impact is nothing new. Impact investment firms, such as Village Capital, already maintain impact metrics on their portfolio companies. Village Capital’s KPI's include amount of carbon emissions offset, number of low-income students served, acres of farmland sustainably managed, kilowatts of solar power installed, etc. Social entrepreneurship accelerators, such as Halcyon Incubator, also track impact metrics. Halcyon uses broad KPI's, including number of lives impacted globally and number of jobs created, because the companies that they serve span a wide range of sectors. Although impact investment firms and social entrepreneurship accelerators maintain impact KPI's, the companies that they serve are ultimately responsible for reporting the data. Essentially, the investment firms and accelerators ask for the data that they want, and the companies give it to them. This brings us to standardization of KPI's. Standardizing KPI’s In the cases of Village Capital and Halcyon, a central authority acts to standardize KPI's by asking companies for certain data. Using the Startup Commons KPI Data Dashboard, ecosystem developers can standardize KPI's throughout their ecosystem. This puts startups, support providers, and entrepreneurship education providers on the same page. The KPI Data Dashboard also makes it simple for policy makers to understand what is working in their economic development efforts. Additionally, ecosystem developers can use the KPI Data Dashboard’s API’s to share data with other parties. For example, ecosystem developers in multiple cities could share data between their startup ecosystems to compare economic development policies. They could also share the data with foreign investors to attract them to their regions. Of course, sharing data only makes sense if KPI’s are coordinated across startup ecosystems. This is why collaboration is key to global startup ecosystem development. Applying LEO-I Now, you hopefully understand how to overcome the problems with LEO-I and can successfully apply the model to your startup ecosystem development efforts. Whether you work for an investment firm or entrepreneurship education provider, you need to be sure to standardize your KPI’s across organizations. By placing an ecosystem development team in charge of your ecosystem data, you can create a centralized authority to standardize KPI’s and apply the LEO-I method to benchmark your ecosystem’s entrepreneurship education efforts. |

Supporting startup ecosystem development, from entrepreneurship education, to consulting to digital infrastructure for connecting, measuring and international benchmarking.

Subscribe for updates

Startup ecosystem development updates with news, tips and case studies from cities around the world. Join Us?Are you interested to join our global venture to help develop startup ecosystems around the world?

Learn more... Archives

December 2023

Categories

All

|

- Startup Commons

- Business Creators

-

Support Providers

- About Support Providers

- Learn About Startup Ecosystem

- Startup Development Phases

- Providing Support Functions

- Innovation Entrepreneurship Education

- Innovation Entrepreneurship Curriculum

- Growth Academy eLearning Platform

- Certified Trainers

- Become Growth Academy Provider In Your Ecosystem

- Growth Academy Training On-Site By Startup Commons

-

Ecosystem Development

- About Ecosystem Developers

- What Is Startup Ecosystem

- Ecosystem Development

- Ecosystem Development Academy eLearning Platform

- Subscribe to Support Membership

- Ecosystem Operators

- Development Funding

- For Development Financiers

- Startup Ecosystem Maturity

- Case Studies

- Submit Marketplace App Challenge

- Become Ecosystem Operator

- Digital Transformation

- Contact Us

- Startup Commons

- Business Creators

-

Support Providers

- About Support Providers

- Learn About Startup Ecosystem

- Startup Development Phases

- Providing Support Functions

- Innovation Entrepreneurship Education

- Innovation Entrepreneurship Curriculum

- Growth Academy eLearning Platform

- Certified Trainers

- Become Growth Academy Provider In Your Ecosystem

- Growth Academy Training On-Site By Startup Commons

-

Ecosystem Development

- About Ecosystem Developers

- What Is Startup Ecosystem

- Ecosystem Development

- Ecosystem Development Academy eLearning Platform

- Subscribe to Support Membership

- Ecosystem Operators

- Development Funding

- For Development Financiers

- Startup Ecosystem Maturity

- Case Studies

- Submit Marketplace App Challenge

- Become Ecosystem Operator

- Digital Transformation

- Contact Us

RSS Feed

RSS Feed