|

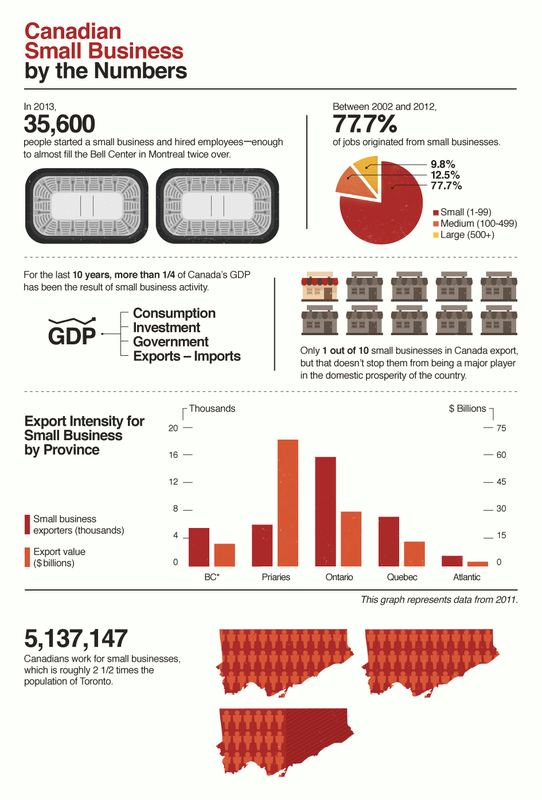

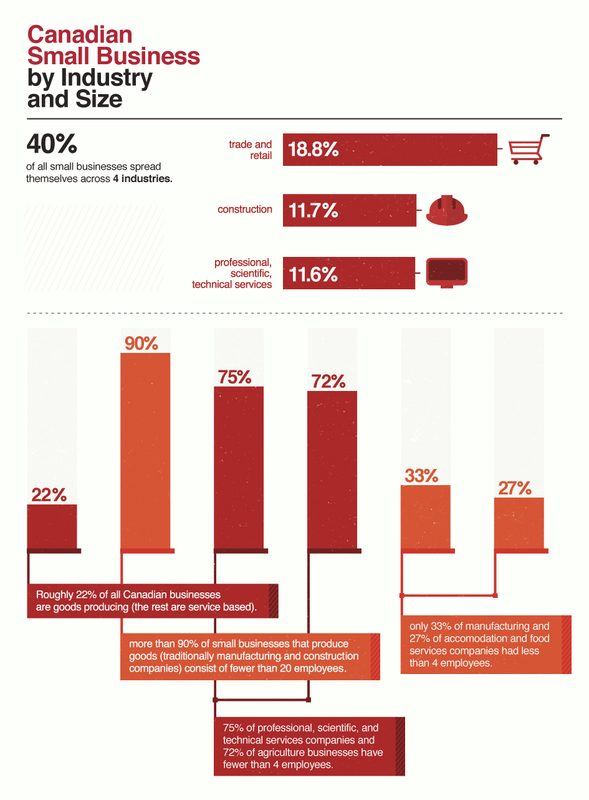

Small business in Canada looks very different compared to the corner store or independent restaurant that may come to mind. As the tech boom stretches its far-reaching tentacles across the world, there’s no set formula for small business anymore. Sure, there’s the standard mathematical definition of a small business—a company with fewer than 100 employees. But what constitutes a small business in 2014 can take on many different forms, especially as the limits of what just a few people can achieve in a short time expands. Setting out on the Small Business Path Nancy Peterson worked in senior management for Fortune 500 companies before she started her at-home business, a site where people can post reviews of home renovators and building contractors. The company has 50 employees and $5 million in annual revenue and has grown at a steady clip of 50 percent each year for the last three years. Intriguingly, it was only as the company approached 50 employees that it moved into an actual office space. The Canadian small business scene often has a lot of tech startups, which leads to local success stories of prospering businesses. Ecommerce platform Shopify, founded in 2004 out of Ottawa, now has 500 employees. Today, it’s worth millions. British Columbia, Alberta, Saskatchewan, and Manitoba rank in the top provinces in terms of invested venture capital. All of these areas are hotbeds for small businesses with big dreams. From Little Things, Big Things Grow: Small Business Communities The small business tradition doesn’t include just companies with plans for global domination. It also includes the micro-enterprise, or the Mom and Pop level, which is defined as having fewer than four employees. Take, for example, a married couple who owns and maintains a bed and breakfast. While they may hire groundskeepers, the occasional waiter, or concierge during busy seasons, B&B owners fit in closely with Industry Canada’s statistical picture of small businesses at the very minute end of the scale: They’re older, rely on the business as their sole source of income, and are motivated by the joys and challenges of being their own bosses. Whether it’s a young tech entrepreneur looking to grow a multinational corporation, or a couple running a bed and breakfast, small businesses rise up from communities. They carry the nation. A recent report from TD Economics estimated in the last three Canadian recessions, 85 percent of net job creation within the first two years of recovery came from small businesses. Canadians respect this. In a 2011 survey of 2,000 adults there was remarkable consensus on the value of small business to the country: 98 percent of people said small business was important to the country’s future and 94 percent of people said small business was crucial to the local community. More than two-thirds of respondents felt the government was not doing enough to help this along, a feeling partly remedied in 2013 by new support for small businesses in Canada’s Economic Action Plan. This included tax relief for new equipment, hiring credits, and better tax cuts for small businesses. An Army of Entrepreneurs: Canadian Small Businesses by the Numbers With a quick look at the numbers, it’s clear small businesses are a real cornerstone of the Canadian economy. According to theBusiness Development Bank of Canada (BDBC), there are 1.1 million small businesses in the country. Technically, 98.2 percent of all business in Canada falls into this category, with 87 percent of all small businesses comprised of fewer than 20 employees. The people running smaller companies are also a more diverse group of business leaders. Women lead one third of the small businesses, an impressive figure when compared to the total paucity of female leadership at Canada’s largest companies. Small Business Is an Emblem of Canadian Resilience Small business in Canada shows off something of the country’s national resilience: 2.7 million Canadians are self-employed. In these post-global financial crisis times, the greater Canadian economy isn’t adding jobs at a great pace. The Canadian labour force is largely static compared to five years ago. Against this trend, small business in Canada is in itself extraordinarily resilient. Despite a general economic stagnation, small businesses are the only group where employment has slowly ticked upward in the last five years. Employment in larger enterprises cratered in 2009 and is just working its way back to even. Small businesses are survivors, too. In fact, companies with fewer than 100 employees have a better survival rate than those with fewer than 500 over a two-year span: 86 percent to 80 through year one, and 85 percent to 72 percent through year two. Sure, the rate of new small businesses created may be significantly down—the 35,000 new businesses created in 2013 is just a snippet compared to the historic highs of 115,000 in 2005—but these companies are still holding their own, outshining other economic groups and supporting the country. It’s a hard working group, too. The average Canadian worked a 35-hour workweek in 2010. The average self-employed Canadian worked a 40-hour week. And 31 percent of self-employed Canadians reported working more than 50 hours a week that year. For the rest of the working population? Just four percent recounted working 50-hour weeks. Location, Size, and Industry While Ontario, with one third of Canada’s population, accounts for roughly 35 percent of all small businesses, Alberta, Saskatchewan, and British Columbia have a higher density of small businesses. Small businesses in Nunavut and the Northern Territories contribute more to GDP on average ($4.2 and $3.7 million respectively), but that’s largely because of their lower populations. Compared to the larger population centers such as Ontario, small businesses in Saskatchewan, Newfoundland, Labrador, and Alberta contribute more per company to GDP. Money Makes Everything Go Around: Small Business Finances Access to capital and resources is key for small businesses trying to grow. Thirty percent of companies applied for debt financing in 2013. However, if the scope is expanded to include leasing, equity finance, and trade credit, 55 percent of companies were involved in some form of financing last year. Small businesses generally find it easy to gain access to money when they ask, with 85 percent of all applications approved. The bigger the business, the more certainty there is for a rubber-stamped application. Companies with fewer than 10 employees boasted a success rate in the lower 80 percent range. That figure rises up to 93 percent for financing applications from companies with 20 to 100 employees. Naturally, the bigger the company the higher the ask: Companies with 20 to 100 employees were borrowing an average of $680,000, while those with one to four were asking for $120,000. Innovation is a major contributor to growth, and small businesses play an important role in adding to the collective pool of intellectual property in Canada. In 2012, small businesses in Canada spent $4.8 billion on research and development, which is close to a third of the country’s total pool of R&D investment. Elsewhere, small businesses needed financing most often for working capital—machinery, vehicles, and real estate—as well as pressing needs and to a lesser, but still significant, extent with hardware and software. Conclusion Small business in Canada is a surprising ecosystem: a web of smaller enterprises combining together to provide the country with an often overlooked economic backbone. It’s an army of workers right under the nation’s proverbial nose, large and diverse, strong and resilient, and definitely not to be underestimated. This is an edited version of a post originally posted at http://blogs.salesforce.com/, by Salesforce Canada. You are free to re-edit and repost this in your own blog or other use under Creative Commons Attribution 3.0 License terms, by giving credit with a link to www.startupcommons.org and the original post.

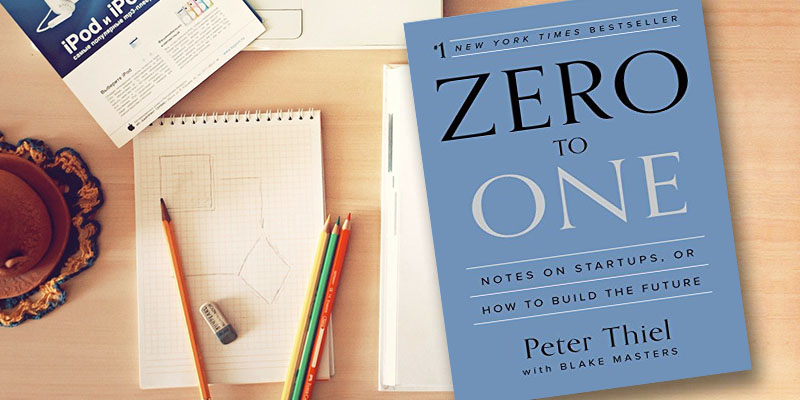

PayPal founder Peter Thiel offers 12 useful tips for entrepreneurs based on his own experience in startups and investing. Aptly called ‘From Zero to One,’ his 210-page book makes for a quick and useful read, with lots of case profiles gathered along his Silicon Valley journey. He describes his book as an “exercise in thinking,” and not a manual for starting up. “Every time we create something new, we go from 0 to 1. The act of creation is singular, as is the moment of creation,” he begins. He charts two kinds of progress: linear (eg. globalisation) and non-linear (technology jumps).

“A startup is the largest group of people you can convince of a plan to build a different future,” Thiel defines. A startup sits at the sweet spot between a lone genius and a large bureaucratic organisation – size allows it to execute on ideas and smallness helps with agility. Thiel sets the context for startups by describing lessons learned from the booms and busts of the DotCom era and cleantech. Be bold, plan well, focus on sales as much as products, blend small steps with big vision, and become so good in your field that you have a sustainable monopolistic lead over the competition. Create long-term value for customers – but also extract value for your firm. Don’t just focus on the rules of the game – change the very board on which you are playing. These are expanded upon in the book’s 14 chapters. (See also other Top 10 Books for Entrepreneurs from 2013 and 2012.) 1. Breakthrough innovation or incremental improvement: where do you want to play Aspiring entrepreneurs should study growth cycles of industries they pick. Online software products can scale exponentially fast and on the global map, while many service sectors scale linearly (eg. consulting, yoga training). Some sectors are in decline (print newspapers), others have relatively short lifespans (restaurants, nightclubs) or are dependent on consumer whims (movie industry, gaming). Some sectors will thrive and endure if they ride long-term trends in tech, demography and environment (eg. rise of digital products like smartphones especially among youth; global warming). Regulation affects the activities and scope of sectors such as biotech, but not as much in software. “Numbers alone won’t tell you the answer, instead you must think critically about the qualitative nature of your business,” Thiel advises. This helps think of business opportunities a decade or more into the future. Do you want to be in a scaleable industry, or do you want to be in a linear sector with many competitors? 2. Build valuable proprietary technology “Proprietary technology must be at least 10 times better than its closest substitute in some important dimension to lead to a real monopolistic advantage,” says Thiel; otherwise it will give only short-term incremental advantage. Google search, Paypal’s online payment, Amazon’s inventory size and Apple’s design are good examples here. 3. Think big Lean and agile approaches to entrepreneurship are a methodology, not a goal – they can take you to a local maximum and not the global maximum, says Thiel. Having a big vision and plan helps deal with industry positioning. For example, Facebook turned down the $1 billion acquisition offer from Yahoo because Mark Zuckerberg could really see where his company could go, and Yahoo did not. Steve Jobs developed a long term vision for Apple with a pipeline of products for years to come. 4. Start small and leverage network effects Networks unleash powerful viral effects. But success requires starting with small networks and then scaling them. “An entrepreneur can’t benefit from macro-level insight unless his own plans begin at the micro-scale,” advises Thiel. Facebook began as a network for Harvard students, then all students and eventually anyone in the world. Don’t start with technology which works only at scale, it should grow with scale. Ideally, the potential for scale should be in the original design itself, eg. Twitter. Amazon began with only books, added similar products like CDs, and then scaled all the way. PayPal began with Palm Pilot users and eBay PowerSellers, and then kickstarted a virtuous cycle by paying early customers to sign up and get referral fees. 5. Understand the Power Law of venture capital Many startups launch and scale thanks to angel and venture capital. But many investors choose a “spray and pray” approach with diverse portfolios instead of realising that exponentially growing companies need extra attention and resources. Thiel’s Founders Fund focuses on only five to seven companies that can become multi-billion dollar firms. After all, venture-backed firms created 11% of all jobs in the U.S., with revenues accounting for 21% of its GDP; the dozen largest tech firms are all venture-backed, Thiel says. 6. Identify secrets – and go after them Thiel identifies two kinds of secrets: secrets of nature, and secrets about people. “The best entrepreneur knows this: every great business is built on a secret that’s hidden from the outside world,” he says. This calls for steady investment in innovation. HP had a good decade of innovation in the 1990s, but has now lost steam. 7. Foundations: strike the balance between ownership, possession and control “As a founder, your first job is to get the first things right, because you cannot build a great company on a flawed foundation,” Thiel explains. There should be clarity and formal documentation on ownership (equity, vesting), possession (operational authority) and control (board of directors). The trick is in finding the right balance in pay (cash, perks, equity) as well as size and composition of the board of directors. 8. Build a solid culture “A startup is a team of people on a mission, and a good culture is just what that looks like on the inside,” says Thiel. In the long run, the balance between creativity and best practices should ensure that the startup innovates, reaps the benefits of innovation effectively and continues to innovate. A culture of excitement is what creates a company that endures – not just pay and perks. Beyond professionalism, PayPal had such strong ties between its founders inside and outside the workplace that they supported each other’s ventures even after the company was sold. Among the ‘PayPal Mafia,’ Elon Musk founded SpaceX and Tesla Motors; Reid Hoffman founded LinkedIn; David Sacks founded Yammer; Steve Chen, Chad Hurley and Javed Karim founded YouTube; and Thiel himself went on to found Palantir. 9. Master marketing and sales Many techies do not have a deep enough understanding of the dynamics and inter-connects of marketing, advertising, sales and distribution, which vary in B2C and B2B sectors. Some of these activities are about creating impressions and attachment among users, others are about cultivating long-term relationships. B2B sales are complex and require ‘rainmakers,’ whereas ‘megaphone’ strategies like TV ads may be better for B2C products. “Selling your company to the media is a necessary part of selling it to everyone else,” Thiel advises, this calls for a clear public relations strategy. 10. Create a powerful brand Apple is a good example of successful branding via sleek design, branded stores, catchy ads and trademark keynotes and launches. But no technology company can be built on branding alone, cautions Thiel. 11. Think beyond ‘Dumb Data’ – use computers as tools It has become very fashionable to talk about Big Data and analytics automation, but Thiel says computers should be seen as tools which complement rather than substitute human effort. PayPal overcame its challenges in dealing with payment fraud by creating a “man machine symbiosis” between algorithms and financial experts. Thiel’s current startup Palantir also uses a human-computer hybrid to blend digital intelligence tools with trained analysts. LinkedIn does not try to replace recruiters with technology, but gives them valuable profiling tools. 12. Understand the Founder’s Paradox There are always raging debates about when it is good to have a company led by the original founder or to bring in a professional manager. Many founders, interestingly, do not neatly fall into the Bell Curve distribution of personality types – they may exhibit both extremes in themselves at different times, eg. charismatic as well as disagreeable, insider and outsider. Good examples here are Richard Branson, Steve Jobs and Sean Parker. Society should become accepting of the unusual traits of founders, but at the same founders should not expect hero worship. “The single greatest danger for a founder is to become so certain of his own myth that he loses his mind,” cautions Thiel. Thiel distills these principles in action by applying them to the cleantech boom and bust, and the few surviving success stories. Companies must not neglect even one of the seven key questions about Technology, Timing, Monopoly, Team, Distribution, Durability and Secret. Elon Musk’s Tesla has great products (even used by Mercedes), its timing to get government grants was perfect (during the cleantech boom and before the bust), it has monopoly in some segments (electric sports cars and luxury sedans), it has a crack team (like ‘Special Forces’ as compared to regular army), it controls its own distribution for better customer connect, its brand is durable, and the company has ‘secret’ insights such as fashion awareness of its customers (eg. Leonardo diCaprio). “Winning is better than losing, but everybody loses when the war isn’t worth fighting,” Thiel adds, citing examples like the legendary clashes between Larry Ellison (Oracle) and Tom Siebel (Siebel Systems). “If you can’t beat a rival, it may be better to merge,” Thiel says, citing the Paypal merger with Elon Musk’s X.com. “Beginnings are special. They are qualitatively different from all that comes afterward,” says Thiel. “Our task today is to find singular ways to create the new things that will make the future not just different but better – to go from 0 to 1 and not just 1 to n,” he concludes. ___________________________________________________________________________________________ This is an edited version of a post originally posted at http://yourstory.com/, by Madanmohan Rao. You are free to re-edit and repost this in your own blog or other use under Creative Commons Attribution 3.0 License terms, by giving credit with a link to www.startupcommons.org and the original post. Startups often represent excitement in the small business world, because of their ability to innovate with great new ideas. Some even grow into giants that become household names and many have created products and services that make our lives easier. Despite a major bump in the road with the recent recession, startups have still grown by 49 percent since 1982. And in their first year, new startups create an average of three million jobs. Obviously, these small businesses serve an important function in our economy. Take a look at the infographic below and find out more about the world of startups, from the best places to launch them to their survival rates and more! This is an edited version of a post originally posted at The Payroll Blog, by Stefan Schumacher is the editor of The Payroll Blog. He has 10 years of experience as a journalist, including as a producer for syndicated radio, a newspaper reporter and editor, and a trade magazine writer and editor. You can connect with Stefan on Google Plus. You are free to re-edit and repost this in your own blog or other use under Creative Commons Attribution 3.0 License terms, by giving credit with a link to www.startupcommons.org and the original post.

Every startup will have a passionate entrepreneur behind it who fell in love with an idea enough to give it his all. But to succeed, that is not enough. Others have to fall in love with your idea too. Others include investors. Here are the top traits that emerged out of the discussions. These are 3 key questions investors will seek answers from entrepreneurs before deciding on funding the startup.

1) Do you have the guts and drive to cross the dark valley? “When an entrepreneur succeeds, there is so much glamour and halo attached to them. What is forgotten or undervalued is the walk through the dark valley entrepreneurs go through,” Vani Kola, Managing Director, Kalaari Capital, told us. Before she became a VC, Vani Kola had built two successful companies in Silicon Valley and exited them with billion-dollar valuation. “There are times when you can’t access capital, nobody believes in your idea, and even when you are winning or think you are winning, nobody really gives any value to the growth you are creating. Sometimes you don’t know how in the next six months you can take your business to the next level. There are so many lonely, dark spots in the growing of your business. As I have experienced those personally, I look at an entrepreneur and see, do they have the guts and drive inside them to cross that black hole? Will they get consumed by that? Will they quit or will they persevere?” This is one quality she looks for in an entrepreneur. “That elusive quality of perseverance — People who can compartmentalise these inevitable problems, which are costs every entrepreneur has to bear, and have immense faith on their product or service, and have a deep passion to pursue it — is something that I, having been an entrepreneur myself, empathise with. On the days things don’t go great, this quality will see the entrepreneur through,” she says. 2) Can you transmit your passion and faith to the investor? At the stage of seed and series A round of funding, an entrepreneur doesn’t have the numbers to back him, and therefore investors have a tough decision before them. “You don’t know whether the business will take off or taper off; you don’t know whether the entrepreneur who delivered the business from ten thousand to five millions can actually build a business that looks like it can go to 50 millions. You don’t know whether the team is fully in place to do that. You don’t know whether the market sizing is yet niche or is it going to grow to a 20 million or is it going to cross that 100 million mark which everybody is looking for. And therefore an investor is far more hesitant,” explains Karthik Reddy, co-founder and managing partner of Blume Ventures. “The investors who eventually end up cutting the cheque are those who become equally passionate about solving all those questions. They see that spark in the entrepreneur. They see that market opportunity, just as the entrepreneur sees it. At seed, it is probably an extreme version of that shared passion and faith.” 3) How good is your team or can you build a great team? However good your product is, however good a coder or business head you are, without a complimentary team member or without the ability to build a great organisation you are not going to survive and make it to series A, Karthik Reddy says. “The learning from three years of seed investing is that the team is more important in our evaluation matrix as we mature as a fund. Without a good team, even if you somehow make it to series A, you are probably going to falter before you get to series B, leave alone grand hundred million exit stories.” According to him, investors should walk away from the opportunity, however best the idea might be or however much they relate to the idea if the team isn’t strong enough or the entrepreneur looks unlikely to be a good team leader. “After all, an investor is not going to run the startup for the entrepreneur. So fundamentally, if they are not going to make their business work themselves, you shouldn’t invest in it.” _____________________________________________________________________________________ This is an edited version of a post originally posted at yourstory.com, by Malavika Velayanikal is Executive Editor of YourStory.com and Innovation Junkie. You are free to re-edit and repost this in your own blog or other use under Creative Commons Attribution 3.0 License terms, by giving credit with a link to www.startupcommons.org and the original post. It is very typical to measure mature of startups ecosystems in terms of new startups, growing startups, investors, investments, exits, etc. and it makes sense as cities use these statistics in the best possible way to communicate their economic growth at high level and to attract other relevant people, investors, big companies, more entrepreneurs and other stakeholders. These indicators are however the result of many smaller activities present in a startup ecosystem that contribute to these higher level results - as any startup ecosystem is the sum of multiple variables of an unbalanced equation inherent to the interactions of the startup ecosystem itself. So, as you can figure out, you need much information to talk about matureness of startups ecosystems. But most of all, you need a good understanding and analysis of your startup ecosystem at different levels and mapping it usually is a good starting point to set up new strategies and achieve a better economic development. But the thing is that properly mapping a startup ecosystem is more than just to create a good map to show who is who in your city or region. It is crucial to work at different levels and in more detail:

We truly believe everyone should work on this model, as it makes the investments to growth and innovation truly visible and measurable - as only the things that can be measured can be improved. And the faster the feedback loop, the faster things can be improved. Actually we are working with this model with few key cities like Helsinki at ecosystem level and even more broadly with independent organizations and we are clearly seeing that it is possible to build a vibrant startup ecosystem in a city in three to five years, what is half or less, compared to known average. Future entrepreneurs and current startups deserve this new scenario that we at Startup Commons are creating and we encourage others to contribute and develop innovation, better, faster and with less resources. Are you a consultant or an entrepreneur? - Learn more about Growth Academy Online Training & Certification Programs Download our startup booklet and watch our videos to learn more about our framework to help startups to grow without "reinventing the wheel" and without wasting lot of time trying to connect the dots. The framework is based on the startup development phases and aims to remove the highest universal risks on the startup journey. This is an originally posted by Óscar Ramírez, CEO Startup Commons. You are free to re-edit and repost this in your own blog or other use under Creative Commons Attribution 3.0 License terms, by giving credit with a link to www.startupcommons.org and the original post

In his new book, Biz Stone, the Co-founder of Twitter, discusses the power of creativity and how to harness it through stories from his remarkable life and career. Stone is known as the creative, effervescent, funny, charming, positive, optimistic, altruistic and yet remarkably savvy Co-founder of Twitter. His book Things a Little Bird Told Me: Confessions of the Creative Mind spans 224 pages and 18 chapters, and covers the pivotal and personal stories from his life along with lessons earned and learned the hard way.

Born in Boston in 1974, Biz Stone’s first startup was Xanga. He was recruited by Google in the early 2000s, and connected with Blogger founder Evan Williams; the pair later left to work on their own startup Odeo. Twitter was founded in 2007 after a hackathon when the original videocasting product did not pan out as materialised. Twitter’s dizzying global success led to Stone being recognised by ‘Time’ Magazine as one of the most influential persons in the world. His other books include Who Let the Blogs Out? A Hyperconnected Peek at the World of Weblogs. “Creativity is what makes us unique, inspired and fulfilled. This book is about how to tap into the creativity in and around us all,” Stone begins. Here areTop 20 Takeaways from his book, offering insights into creativity, ethics and global vision. 1. Create opportunities, don’t wait for them “Opportunity is manufactured,” says Stone. Don’t wait for circumstances to align your stars, go ahead and make the opportunity yourself. He used this principle even in school days to create a lacrosse team since he was not good in other sports; he also landed his first job as a book cover designer by submitting a cover to the art director even though he was just interning as a delivery boy. 2. Start with an idea Don’t dig into specifics first, start off with an idea. “If you take an idea and just hold it in your head, you unconsciously start to do things that advance you toward that goal,” says Stone. “Have confidence in your ideas before they even exist,” he advises. Sometimes even a sense of desperation that you will eventually get an idea will keep you going. 3. Invest emotionally in your idea “If you don’t love what you are building, if you’re not an avid user yourself, then you will most likely fail even if you are doing everything else right,” says Stone. His startup Odeo did not go too far because he was not into audio podcasts himself, and therefore missed out on important features such as sound quality. Twitter, on the other hand, brought Stone much more joy and excitement. If you are not engaged, you cannot go on, there will be no gravity. 4. Creativity has infinite approaches One thing Stone learnt as a book cover designer is that there are infinite approaches to frame, understand and solve a problem. If one of your creative ideas does not work or does not find acceptance, let go and move on to another one. Don’t take rejection personally. “Creativity is a renewable resource. Challenge yourself every day. Be as creative as you like, as often as you want, because you can never run out. Experience and creativity drive us to make unexpected offbeat connections. It is these non-linear steps that often lead to the greatest work,” explains Stone. He drew on this principle while working at Google – full of PhDs while Stone himself was a college dropout; he advocated a focus on the human aspects of tools and not just technical. 5. Learn to harness constraints for creativity “Constraint inspires creativity,” says Stone, drawing on a number of examples, including his own. Steven Spielberg had a limited budget for the movie Jaws – so instead of creating an expensive replica, he decided to shoot from the ‘shark’s point of view’ – which turned out to be even scarier. Harrison Ford had the runs while shooting The Raiders of the Lost Ark – and instead of dueling a swordfighter in one scene, he just proposed a gunshot – which became an iconic moment in the film. Due to resource constraints, ARM came up with chips which were just not good enough for PCs – but ended up being perfect for cellphones. “Embrace your constraints. They are provocative. They are challenging. They wake you up. They make you more creative. They make you better,” says Stone. Detractors initially said Twitter’s 140 character limit was constraining – but that unleashed a new form of wit and creativity, and power for activists. Finding The Right Problem The genius lies not in finding the right solution, but in the right problem. An enabling problem, as Thorpe puts it, allows imaginative solutions to spring up that are far removed from your original expectations. Aim for the impossible, but don’t look to the impossible to solve your problems. For example, a disabling problem would be wanting to fly like a bird by flapping your arms. But an enabling problem would be anything that gets your feet of the ground. Finding the right problem will expand your horizons and stretch your thinking. A disabling problem will only impose restrictions and negativity. Breaking The Pattern Humans are creatures of habit. The human mind is loath to do anything that takes it out of its comfort zone. Hence, people feel reluctant exercising, learning a new language or any such thing. Thorpe writes that Einstein was most successful when he was willing to consider anything, particularly ridiculous ideas. Breaking patterns tears you out of your rut by generating novel ideas that people are usually too practical to consider. Constantly pushing oneself to doing and trying new things every day is how patterns are broken and greatness achieved. As the quote goes, “Get comfortable with being uncomfortable. It will take you places.” Breaking The Rules Breaking rules is not a sign of rebellion which you must adopt to distinguish yourself from the majority. Rather, Thorpe comments, it is a focused, deliberate and systematic way of finding solutions. When you have exhausted all acceptable alternatives in your quest for the perfect answer to your problem, the only option is to break the rules and see what solutions it yields. Moreover, the kind of thinking that pathological training and compulsion to obey rules produces is not one that changed the world. Of course, obey the traffic rules and respect each other’s privacy. But in everyday life it is essential to break away from enforced norms and regulations to realize your true vision. Grow The Solution Einstein’s labour of love, the theory of relativity, was eight years in the can before it could be released to the world. Chances are, you already know how you are going to make your mark in the world. The prospect seem impossible, or difficult at the very least, because the idea is raw and obscure. It has to be protected, nurtured and nourished it in your own special ways so it can take root and flower. It requires effort, preparation and perseverance. The mass media would have us believe that all innovators are solution superstars who woke up with the perfect idea one fine morning. Einstein earnestly asks you to believe otherwise. ... read more on yourstory.com This is an edited version of an post originally posted at yourstory.com. You are free to re-edit and repost this in your own blog or other use under Creative Commons Attribution 3.0 License terms, by giving credit with a link to www.startupcommons.org and the original post.

There are many things in entrepreneurship that still remain the same after many years. In this case, we wanted to share the interview that Bambi Francisco from vator.tv did with Yoav Leitersdorf at Innovate!Europe conference, held in Zaragoza, Spain, some years ago. It shares some great and simple to understand tips for new start-up entrepreneurs:

The one extra tip was, it’s OK to fail. European entrepreneurs seem to have VERY different viewpoint to failure. European failed entrepreneurs rarely continue as entrepreneurs and start something new, when in US the most successful entrepreneurs have failed in past. I think this is a VERY important lesson. Europeans should understand to value their biggest lesson that they get from their failure! See the video for the full interview. This is an edited version of an post originally posted at the Grow VC Blog, by Valto Loikkanen. You are free to re-edit and repost this in your own blog or other use under Creative Commons Attribution 3.0 License terms, by giving credit with a link to www.startupcommons.org and the original post.

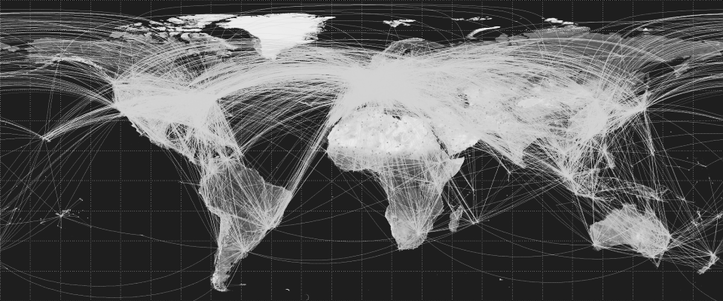

“Startups Ecosystems” has started to appear in Google Trends and this is a good proof about how important these communities are for many regions and countries in order to achieve a sustainable economic development. Fostering entrepreneurial culture, building startups accelerators, launching competitions, mentoring and seeking funding are some of the main activities that are necessary to support startups. It is key to have a good and deep understanding about how these startups ecosystems works if we want to get success and make supporting startups more cost effective, efficient and transparent. One of the players in the startup scene that is understanding quite well these environments is Grow VC Group. Crowd Valley, a Grow VC Group company, now offers a platform and backoffice to many marketplaces and crowdfunding services, not only for startup funding but also to get more effective markets for all kinds of assets. Grow Advisors helps many finance companies, startup ecosystems and investors to build models that can utilize crowdfunding and p2p investing in their investing models. ChangeLab23 builds better usability and software for many growth companies. Grow VC Group is also working to build new co-investing models, and they have a stake in several startup companies as they help to build business for them. This means that Grow VC Group has taken an important role to build enablers and tools for growth companies around the world. They have one more important component, Startup Commons. Startup Commons is a non-profit organization that was launched at a Kauffman Foundation event this summer. It offers tools including a platform to get startups, experts and investors together to build and develop companies, and components that each startup needs, like a Shareholders’ Agreement template. We also cooperate with other organizations, like Mobile Monday, that globally get mobile professionals together and also build new startups. Grow VC Group also works with partners that offer tools and solutions for the same needs. One example is UK-based law services company Lawbite that especially has tailored its law services and online packages for entrepreneurs and startups. It is a good example of how the startup and growth company ecosystem needs new solutions. The old models that have worked for corporates don’t work for all companies. Funding, legal services and support communities for a growth company are good examples of those areas where new solutions are coming. A good understanding is the first step towards the right direction and also is the way to build the future and help next generation of startups to grow smartly, locally and globally. This is an edited version of an post originally posted at the Grow VC Blog, by Jouko Ahvenainen. You are free to re-edit and repost this in your own blog or other use under Creative Commons Attribution 3.0 License terms, by giving credit with a link to www.startupcommons.org and the original post.  Why yes, that is my mirrored handwriting. Why yes, that is my mirrored handwriting. In the modern, networked society it's nothing short of a miracle that some traditional organizations make ends meet. However, in the longer term every inefficient organization will have to come to grips with the new world and adapt to the surroundings. That or face the consequences. This post has a personal grounding to our organization at Grow VC. During the 2011 winter holidays we've spent time planning for the longer term and steering the direction of the ship so to speak. I've had an inkling that I wanted to bring forth in our discussion and it's become the topic of a larger discussion since then. This inkling is namely that in roughly a years time, at the end of 2012, the Grow VC team will have grown to over 100 individuals. Why Not Make It a Thousand? Delving into this subject of scaling the organization, our CEO retorted with a larger number. Why couldn't we instead be over a thousand in the organization after a year? After the intial shock and a few missed heartbeats, it all made sense. Most, if not all great long term organizations have over 1000 people. Why did he ask me that? The reasoning is quite simple. If we think we can't – we never will. And if we don't believe it's possible, then we're in the wrong place. We've gone through the path of scaling the organization and responsibilities, benchmarking and attracting the most brilliant people to our team and we've successfully passed 50 individuals (who we are immensely proud of might I add). How do you grow an organization from the initial team to fifty? Well, just make sure you recruit the best and the rest will follow. At least to a large extent. Fifty is a big number, but it's one that you can still handle by pulling the strings yourself. A thousand (1 0 0 0) on the other hand, you will need a separate recipe for. No One Has a Clue Scaling the organization past fifty individuals requires a different approach. I'm confident we as an organization can do it, that's not the issue. We've got heaps and heaps of confidence. How it will look, that's a completely different topic all together. In attempting to create an efficient, purposeful organization also past the first 100 people, we've looked at making it scalable in building value. We as an organization take scaling very seriously. In developing any organization past a certain number, it becomes clear that no one has a clue. Sure all MBA books are filled ten dollar words on strategic management and how to guide a large organization. But can you really guide an organization of hundreds or over a thousand individuals? Look at how large organizations function, look at how much efficient time individuals have each day. We've approached this dilemma differently. We want to make it work. Interconnected Teams Interconnected teams for an efficiently scaled startup. With our global operations on six continents, it's been important for us to have local people. For us this means people with real ownership, incentives and autonomy to make things happen – you know, entrepreneurs. Teams in this context are nothing but a collection of people, with the before mentioned attributes, who have a set goal, ultimately that is to build value in the organization. Teams mean local teams, task specific teams (e.g. development, UX etc) and functional teams (e.g. the dreaded 'management'). These teams are interconnected and they need to communicate amongst themselves, that is the interconnected part. They should be able to function autonomously, but they should also be able to leverage and learn from one another. The primary links should be between the teams themselves and the secondary links are to 'management'. The primary purpose of 'management' itself should be to provide the targets, metrics, priorities and support when needed in achieving the targets. But maybe most importantly, to get out of the way. Easier said than done, but what is the alternative? The pyramid? No thank you. Guidelines - no Excuses Brilliant people. Documented and proven processes that are constantly developed. Measured targets. The right culture. This is more or less our recipe and so far we're sticking to it. With efficiency and purpose always in mind, everyone is required to build tangible value and get things done. If something doesn't work, fix it. If it does, improve it. It's all about purpose in a team like this and if you dont share the purpose, you aren't part of the team. At the end of the day it's been a delight working with our driven team up to this point and I look forward to all the people that we add on to this journey of globally developing equity crowdfunding. And in our market there are figuratively over 7 billion people and we will find the most brilliant hundred or thousand or whatever may be the number. We've already gone through over 1500 applications and the pace keeps increasing. We will find all the right people, it's just a matter of time. Clearly we at Grow VC are still the exception in terms of how organizations look and we will continue to push the envelope for a good many years. But how long are you willing to bet that the other approach still works? Or is it just a question of a process that no one has thought to question? This is an edited version of an post originally posted at the Grow VC Blog, by Markus Lampinen. You are free to re-edit and repost this in your own blog or other use under Creative Commons Attribution 3.0 License terms, by giving credit with a link to www.startupcommons.org and the original post.

|

Supporting startup ecosystem development, from entrepreneurship education, to consulting to digital infrastructure for connecting, measuring and international benchmarking.

Subscribe for updates

Startup ecosystem development updates with news, tips and case studies from cities around the world. Join Us?Are you interested to join our global venture to help develop startup ecosystems around the world?

Learn more... Archives

December 2023

Categories

All

|

- Startup Commons

- Business Creators

-

Support Providers

- About Support Providers

- Learn About Startup Ecosystem

- Startup Development Phases

- Providing Support Functions

- Innovation Entrepreneurship Education

- Innovation Entrepreneurship Curriculum

- Growth Academy eLearning Platform

- Certified Trainers

- Become Growth Academy Provider In Your Ecosystem

- Growth Academy Training On-Site By Startup Commons

-

Ecosystem Development

- About Ecosystem Developers

- What Is Startup Ecosystem

- Ecosystem Development

- Ecosystem Development Academy eLearning Platform

- Subscribe to Support Membership

- Ecosystem Operators

- Development Funding

- For Development Financiers

- Startup Ecosystem Maturity

- Case Studies

- Submit Marketplace App Challenge

- Become Ecosystem Operator

- Digital Transformation

- Contact Us

- Startup Commons

- Business Creators

-

Support Providers

- About Support Providers

- Learn About Startup Ecosystem

- Startup Development Phases

- Providing Support Functions

- Innovation Entrepreneurship Education

- Innovation Entrepreneurship Curriculum

- Growth Academy eLearning Platform

- Certified Trainers

- Become Growth Academy Provider In Your Ecosystem

- Growth Academy Training On-Site By Startup Commons

-

Ecosystem Development

- About Ecosystem Developers

- What Is Startup Ecosystem

- Ecosystem Development

- Ecosystem Development Academy eLearning Platform

- Subscribe to Support Membership

- Ecosystem Operators

- Development Funding

- For Development Financiers

- Startup Ecosystem Maturity

- Case Studies

- Submit Marketplace App Challenge

- Become Ecosystem Operator

- Digital Transformation

- Contact Us

RSS Feed

RSS Feed