|

Today, it's not hard to stumble across success stories of companies raising capital in alternative ways. By alternative, we mean not using banks or traditional lenders or even business angels. Since the financial crisis of 2007, anyone starting a business has realised raising capital is one of the hardest tasks and a critical area of the business plan. This demand for alternative funding mechanisms has given a rise to a growing industry already estimated to be worth billions of dollars. According to recent research published by The Economist, in 2014 global investment in fintech reached $12 billion, up from $4 billion a year earlier. In addition, Goldman Sachs estimates that global revenues linked to the growth of fintech could be as high as $4.7 trillion. Taking a step back, it's important to realise that funding is just one (important) piece of the puzzle. In addition to securing capital, there is a myriad of resources, services and environmental factors that are critical to startup development. Timely access to professional services (such as legal, tax, accounting and developers / programmers) plays a positive role for startups to succeed. As a result, today we are witnessing the growth of ecosystems designed to support startups and small enterprises in many cities around the world. In dedicated areas or business hubs, incubators, accelerators and shared office spaces, knowledge sharing and mentor services form networks that support thriving business activity. These groups of experts assist startups and ensure they have access to timely knowledge and information they need, beyond capital requirements. In addition, many governments around the world have rolled out new regulations covering equity crowdfunding or P2P lending and online digital investments. Governments are taking active steps to keep up with innovations in finance by providing frameworks and an environment in which operators and participants can transact safely and efficiently. As startup ecosystems grow, so do the associated services that support them. At this highest level of small enterprise planning, neural networks or sophisticated platforms that monitor and manage them connect all stakeholders in real time and with access to critical business data. By using these networks, it is possible to better plan, measure and drive the growth of startups, identify bottlenecks and better allocate resources to them. This is an edited version of an article originally published at http://www.growadvisors.com/blog/funding-startups-and-keeping-a-track-of-the-bigger-picture by Grow Advisors. You are free to re-edit and re-post it under Creative Commons Attribution 3.0 License terms by giving credit to the author with a link to www.startupcommons.org and the original post. Photo credit: Pictures of Money, https://www.cheapfullcoverageautoinsurance.com/. The photo was originally published on Flickr. It has been used to illustrate this text under Creative Commons Attribution 2.0 License terms. No changes have been made.

PayPal founder Peter Thiel offers 12 useful tips for entrepreneurs based on his own experience in startups and investing. Aptly called ‘From Zero to One,’ his 210-page book makes for a quick and useful read, with lots of case profiles gathered along his Silicon Valley journey. He describes his book as an “exercise in thinking,” and not a manual for starting up. “Every time we create something new, we go from 0 to 1. The act of creation is singular, as is the moment of creation,” he begins. He charts two kinds of progress: linear (eg. globalisation) and non-linear (technology jumps).

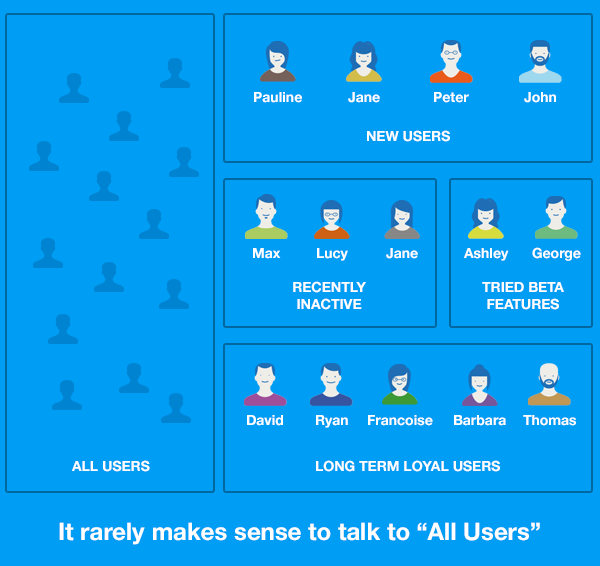

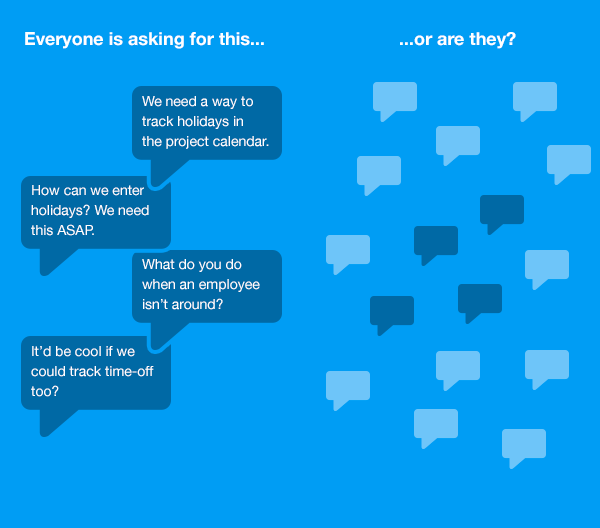

“A startup is the largest group of people you can convince of a plan to build a different future,” Thiel defines. A startup sits at the sweet spot between a lone genius and a large bureaucratic organisation – size allows it to execute on ideas and smallness helps with agility. Thiel sets the context for startups by describing lessons learned from the booms and busts of the DotCom era and cleantech. Be bold, plan well, focus on sales as much as products, blend small steps with big vision, and become so good in your field that you have a sustainable monopolistic lead over the competition. Create long-term value for customers – but also extract value for your firm. Don’t just focus on the rules of the game – change the very board on which you are playing. These are expanded upon in the book’s 14 chapters. (See also other Top 10 Books for Entrepreneurs from 2013 and 2012.) 1. Breakthrough innovation or incremental improvement: where do you want to play Aspiring entrepreneurs should study growth cycles of industries they pick. Online software products can scale exponentially fast and on the global map, while many service sectors scale linearly (eg. consulting, yoga training). Some sectors are in decline (print newspapers), others have relatively short lifespans (restaurants, nightclubs) or are dependent on consumer whims (movie industry, gaming). Some sectors will thrive and endure if they ride long-term trends in tech, demography and environment (eg. rise of digital products like smartphones especially among youth; global warming). Regulation affects the activities and scope of sectors such as biotech, but not as much in software. “Numbers alone won’t tell you the answer, instead you must think critically about the qualitative nature of your business,” Thiel advises. This helps think of business opportunities a decade or more into the future. Do you want to be in a scaleable industry, or do you want to be in a linear sector with many competitors? 2. Build valuable proprietary technology “Proprietary technology must be at least 10 times better than its closest substitute in some important dimension to lead to a real monopolistic advantage,” says Thiel; otherwise it will give only short-term incremental advantage. Google search, Paypal’s online payment, Amazon’s inventory size and Apple’s design are good examples here. 3. Think big Lean and agile approaches to entrepreneurship are a methodology, not a goal – they can take you to a local maximum and not the global maximum, says Thiel. Having a big vision and plan helps deal with industry positioning. For example, Facebook turned down the $1 billion acquisition offer from Yahoo because Mark Zuckerberg could really see where his company could go, and Yahoo did not. Steve Jobs developed a long term vision for Apple with a pipeline of products for years to come. 4. Start small and leverage network effects Networks unleash powerful viral effects. But success requires starting with small networks and then scaling them. “An entrepreneur can’t benefit from macro-level insight unless his own plans begin at the micro-scale,” advises Thiel. Facebook began as a network for Harvard students, then all students and eventually anyone in the world. Don’t start with technology which works only at scale, it should grow with scale. Ideally, the potential for scale should be in the original design itself, eg. Twitter. Amazon began with only books, added similar products like CDs, and then scaled all the way. PayPal began with Palm Pilot users and eBay PowerSellers, and then kickstarted a virtuous cycle by paying early customers to sign up and get referral fees. 5. Understand the Power Law of venture capital Many startups launch and scale thanks to angel and venture capital. But many investors choose a “spray and pray” approach with diverse portfolios instead of realising that exponentially growing companies need extra attention and resources. Thiel’s Founders Fund focuses on only five to seven companies that can become multi-billion dollar firms. After all, venture-backed firms created 11% of all jobs in the U.S., with revenues accounting for 21% of its GDP; the dozen largest tech firms are all venture-backed, Thiel says. 6. Identify secrets – and go after them Thiel identifies two kinds of secrets: secrets of nature, and secrets about people. “The best entrepreneur knows this: every great business is built on a secret that’s hidden from the outside world,” he says. This calls for steady investment in innovation. HP had a good decade of innovation in the 1990s, but has now lost steam. 7. Foundations: strike the balance between ownership, possession and control “As a founder, your first job is to get the first things right, because you cannot build a great company on a flawed foundation,” Thiel explains. There should be clarity and formal documentation on ownership (equity, vesting), possession (operational authority) and control (board of directors). The trick is in finding the right balance in pay (cash, perks, equity) as well as size and composition of the board of directors. 8. Build a solid culture “A startup is a team of people on a mission, and a good culture is just what that looks like on the inside,” says Thiel. In the long run, the balance between creativity and best practices should ensure that the startup innovates, reaps the benefits of innovation effectively and continues to innovate. A culture of excitement is what creates a company that endures – not just pay and perks. Beyond professionalism, PayPal had such strong ties between its founders inside and outside the workplace that they supported each other’s ventures even after the company was sold. Among the ‘PayPal Mafia,’ Elon Musk founded SpaceX and Tesla Motors; Reid Hoffman founded LinkedIn; David Sacks founded Yammer; Steve Chen, Chad Hurley and Javed Karim founded YouTube; and Thiel himself went on to found Palantir. 9. Master marketing and sales Many techies do not have a deep enough understanding of the dynamics and inter-connects of marketing, advertising, sales and distribution, which vary in B2C and B2B sectors. Some of these activities are about creating impressions and attachment among users, others are about cultivating long-term relationships. B2B sales are complex and require ‘rainmakers,’ whereas ‘megaphone’ strategies like TV ads may be better for B2C products. “Selling your company to the media is a necessary part of selling it to everyone else,” Thiel advises, this calls for a clear public relations strategy. 10. Create a powerful brand Apple is a good example of successful branding via sleek design, branded stores, catchy ads and trademark keynotes and launches. But no technology company can be built on branding alone, cautions Thiel. 11. Think beyond ‘Dumb Data’ – use computers as tools It has become very fashionable to talk about Big Data and analytics automation, but Thiel says computers should be seen as tools which complement rather than substitute human effort. PayPal overcame its challenges in dealing with payment fraud by creating a “man machine symbiosis” between algorithms and financial experts. Thiel’s current startup Palantir also uses a human-computer hybrid to blend digital intelligence tools with trained analysts. LinkedIn does not try to replace recruiters with technology, but gives them valuable profiling tools. 12. Understand the Founder’s Paradox There are always raging debates about when it is good to have a company led by the original founder or to bring in a professional manager. Many founders, interestingly, do not neatly fall into the Bell Curve distribution of personality types – they may exhibit both extremes in themselves at different times, eg. charismatic as well as disagreeable, insider and outsider. Good examples here are Richard Branson, Steve Jobs and Sean Parker. Society should become accepting of the unusual traits of founders, but at the same founders should not expect hero worship. “The single greatest danger for a founder is to become so certain of his own myth that he loses his mind,” cautions Thiel. Thiel distills these principles in action by applying them to the cleantech boom and bust, and the few surviving success stories. Companies must not neglect even one of the seven key questions about Technology, Timing, Monopoly, Team, Distribution, Durability and Secret. Elon Musk’s Tesla has great products (even used by Mercedes), its timing to get government grants was perfect (during the cleantech boom and before the bust), it has monopoly in some segments (electric sports cars and luxury sedans), it has a crack team (like ‘Special Forces’ as compared to regular army), it controls its own distribution for better customer connect, its brand is durable, and the company has ‘secret’ insights such as fashion awareness of its customers (eg. Leonardo diCaprio). “Winning is better than losing, but everybody loses when the war isn’t worth fighting,” Thiel adds, citing examples like the legendary clashes between Larry Ellison (Oracle) and Tom Siebel (Siebel Systems). “If you can’t beat a rival, it may be better to merge,” Thiel says, citing the Paypal merger with Elon Musk’s X.com. “Beginnings are special. They are qualitatively different from all that comes afterward,” says Thiel. “Our task today is to find singular ways to create the new things that will make the future not just different but better – to go from 0 to 1 and not just 1 to n,” he concludes. ___________________________________________________________________________________________ This is an edited version of a post originally posted at http://yourstory.com/, by Madanmohan Rao. You are free to re-edit and repost this in your own blog or other use under Creative Commons Attribution 3.0 License terms, by giving credit with a link to www.startupcommons.org and the original post. It rarely makes sense to take feedback from all users and it never makes sense to get it all at once. At the outset of a new project, or especially if you’ve recently taken over a product, it’s tempting to survey all your users to appraise where things are. It’s usually a mistake. In fact there are five common mistakes that we see over and over. Intercom makes getting feedback extremely easy, and as a result, it’s easy to become a little trigger happy with the feedback requests. Here’s five quick fixes for product feedback: 1. Stop talking to “all users” When you survey all your users together you ignore the specifics. You mix up yesterday’s sign-ups with life long customers. Those who used your product every day with those who log in just to update billing details. Those who only use one specific feature with those who use them all. It’s a mess. Solution: There’s a much cleaner way to get much better feedback. Here’s some examples:

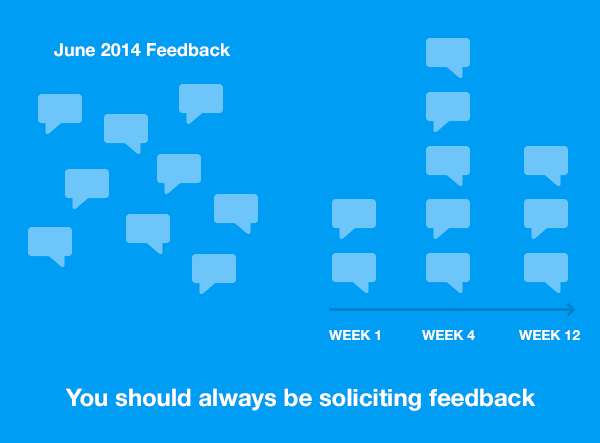

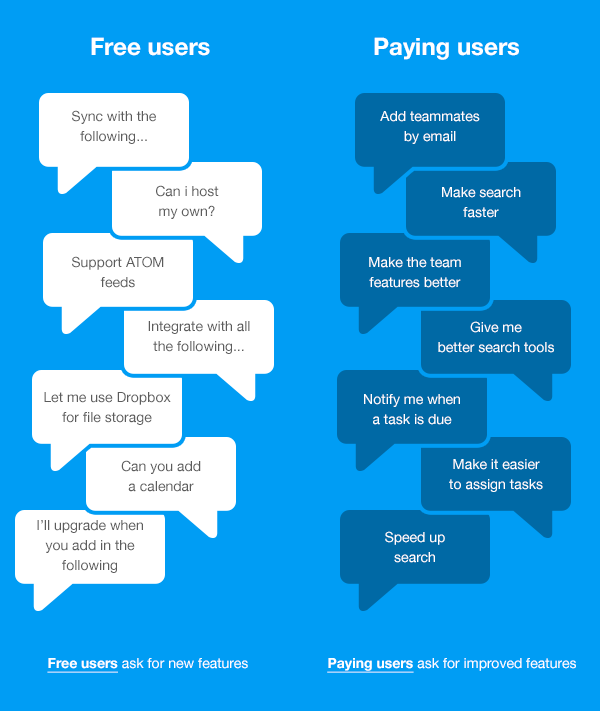

2. Feedback should be on-going The default approach to feedback is to solicit it on demand. But that means when you realise you need it you have to wait a week doing nothing while it comes in. To compensate for this you cast a very wide net, ask a lot of questions, and sit back. If you’re particularly naive you’ll act on each piece as it comes in, rather than waiting and analysing it in whole. The problem here is twofold: firstly you never have feedback to hand when you need it, but secondly you only hear about problems when you choose to ask about them. This means you’re blind to gradual degradation of your product. Solution: Periodically check in with users. The simplest, yet still valuable, version of this is to ask users for feedback on day 30, 60, 120, 365, etc. This takes about 20 seconds to set-up in Intercom, and will pay for itself in a day or two. A slightly more advanced version would be to gather feature specific feedback based on usage. For example, if you have a calendar tool, you might ask someone for their thoughts on the first, twentieth and fiftieth time they use. As a user gets used to a product their feedback matures. The first usage feedback will explain what’s confusing, the twentieth will explain the frustrations, the fiftieth will explain the limitations. 3. Distinguish Free from Paying Feedback Related to point 1, it’s easy to assume all requests are of equal value, regardless of the state of an account. This is roughly true within certain thresholds (e.g. $50->$500) but there’s a noticeable difference between the type of requests you get from free users and from paying users. Long term free users are only capable of giving you feedback on how to improve your free plan, which is rarely a focus for a business. Typically, free plans exist to draw customers in and upsell them. You can’t listen to hypothetical feedback: “I’ll upgrade if…”, “I’ll upgrade when…”. Espoused behaviour is rarely useful, learn from things that actually happened. Solution:

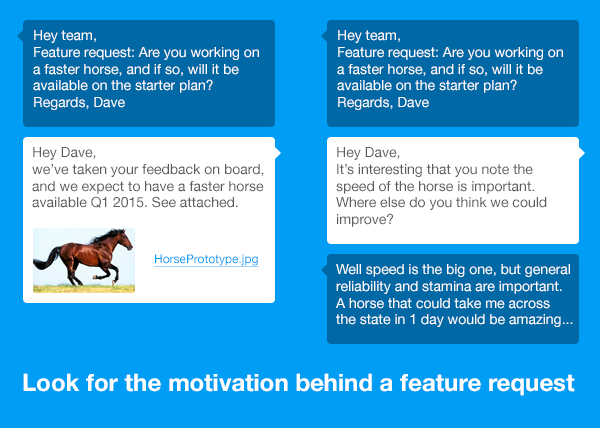

4. Don’t fall for the vocal minority It’s often said the plural of anecdote is not data, but that does not mean anecdotal evidence is not useful. The plural of anecdote is a hypothesis, or narrative. Something that’s easily verifiable. So on a day when five users ask for a simpler event form in the calendar, you don’t assume five people represent all users and immediately kick off an “event simplification” project. First you should attempt to verify if these five users represent all users. You start talking to calendar users, and see what else comes up. Solution: Treat every clustering of feedback that you see as a hypothesis, and then don’t build it, verify it. Once you verify that the pain is real, the next step is never “build the requested solution”, you have to go deeper. Which brings us to the last point. 5. Don’t assume users request the right feature To paraphrase Confucious, when customers point to the moon, the naive product manager examines their finger. The faster horses tale is often used to justify not listening to customers, but that’s an epic way to miss the point. If a customer says they want a faster horse, what they’re actually telling you is that speed is a key requirement for transport. So you think about how you deliver that. In our previous example, our friend had five people complaining that her new event form was too complex. She could have lost weeks building a natural language input, or streamlining the UX of the form, but it turns out none of that would have helped. When she talked to all the calendar users, she quickly learned the pain came not from the form complexity, but from how often it had to be used. What actually solved the pain was recurring calendar events, and making events easy to duplicate.

Solution: Be aware that customer feature requests are a cocktail of their design skills, their knowledge of your product, and their understanding of their current pain point. They know nothing of your product vision, what features you’re currently working on, or what’s technically possible. This is why it’s essential to abstract a level or two above what’s requested, into something that makes sense to you, and benefits all your customers. Of course it’s worth noting occasionally a feature request will be spot on. It will rhyme with every thing else and perfectly fit in the world the way you see it. On these occasions you can skip steps, namely verification, abstraction, and clustering and trust your gut. Your product intuition gives you wonderful shortcuts, so long as you’re still a true user of your product, and constantly in touch with the needs of your users. But on every other occasion, talk to your customers, it makes you smarter. ______________________________________________________________________________________________ This is an edited version of a post originally posted at http://blog.intercom.io, by Des Traynor, Co-founder @intercom.You are free to re-edit and repost this in your own blog or other use under Creative Commons Attribution 3.0 License terms, by giving credit with a link to www.startupcommons.org and the original post. How do you know whether your idea you have is worth your time and effort? Wouldn't you like to find out it as soon as possible?

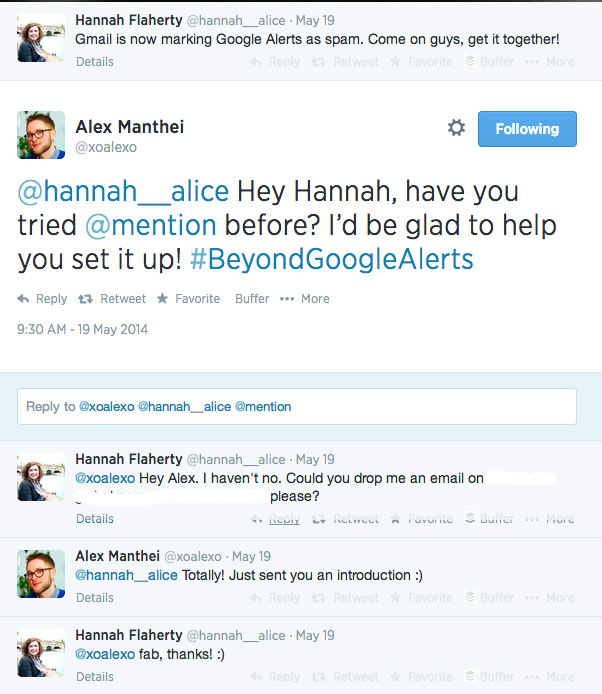

Many people put their ideas on the back burner, uncertain if they have potential or daunted by the amount of money they'll need to get started. It doesn't have to be this hard. There are four questions that will help you predict whether your startup idea will be succesfull or not. 1. HOW BIG IS THE PROBLEM? Before doing anything else, figure out if you're solving a real problem and for who you are solving it for (the customer). If you have a sense of who your customers are based on previous interactions, go interview them. Set up a coffee meeting or a phone call to ask them a few questions and further understand how you can solve for their needs. Conducting effective customer interviews takes practice and interpreting the qualitative data that they provide can be subjective. You can use the problem interview scoring technique to quantify results and make a faster decision based on the score. An interview score of 25 or higher indicates that you're onto something with the problem you want to solve. 2. HOW MUCH WILL CUSTOMERS PAY FOR YOUR SOLUTION? If you're not sure who your customers could be or have a few ideas you want to test quickly, start with a landing page experiment instead, then interview people once they sign up. Include a price point on your landing page and use Google Adwords to drive targeted visitors to your page. Measure the number of visitors who convert and leave their emails based on the price you set. Aim to get a 10 percent to 15 percent conversion rate to proceed with your idea. Test different price points and determine the value of a customer even before building your business. You can use QuickMVP to set up this experiment in five minutes. 3. HOW MUCH DOES IT COST TO ACQUIRE EACH CUSTOMER? After you've validated that people will pay you to solve their problem, figure out how much it costs to get more people to your product. Paid Ads are a good technique to calculate Customer Acquisition Cost (CAC) early on since it gives you a representative customer sample and their conversion rate. -> Customer acquisition cost = Total spent on ads/# of paid conversions on landing page To build a sustainable business, the acquisition cost should be significantly less than what customers pay to use your service. 4. HOW BIG IS THE MARKET & HOW ACCESSIBLE IS IT? Now that you've acquired a handful of customers, can you get 1,000? 10,000? Is the opportunity big enough? Find out early. Many startups have shut down because they could not acquire enough customers. To get an idea of your market size, look at the search volumes of relevant Google keywords. Find uncompetitive keywords with a high search volume to reach a large market at a low acquisition cost. If your keywords are popular but competitive, you're entering a saturated market and will have a harder time scaling. Next time you have a great idea, jot it down and test it with these four questions. The sooner you test your ideas and get answers, the sooner you'll know which idea is worth pursuing. All it takes is a landing page and Google Adwords to get started. _________________________________________________________________________________________ This is an edited version of a post originally posted at http://www.iafrikan.com/ by Grace Ng who is a Co-Founder of Javelin, an enterprise software and services company for implementing Lean Startup. You are free to re-edit and repost this in your own blog or other use under Creative Commons Attribution 3.0 License terms, by giving credit with a link to www.startupcommons.org and the original post. Knowing what your customers think about you and your brand is clearly invaluable information, but you’d be surprised by how many companies build for themselves rather than for their customers’ needs. Yes, we all like to work on projects we’re passionate about, but a business needs to be profitable (eventually), or at least break even for now. Here’s how listening to what current and potential customers are saying will help you build and grow revenue for your business. 1. Lead generation Pay attention to conversations around keywords related to your brand to identify potential customers and the problems and needs they’re trying to solve for. Use this as an opportunity to join in the conversation and build a valuable relationship. Front, a tool for sharing company email accounts, was able to recruit 15 high quality beta users every week with this approach. How to generate leads with media monitoring:

2. Competitive monitoring Much like keyword monitoring, you can monitor what people are saying about your competitors. It’s possible that your potential customers:

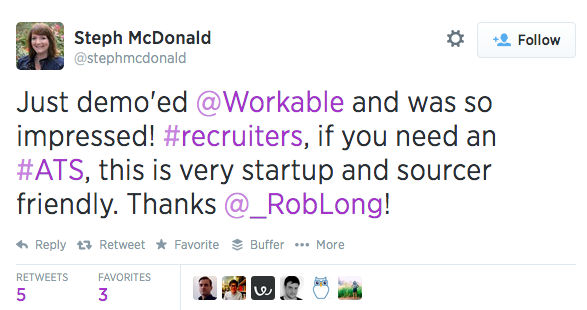

Use a media monitoring tool to track these conversations, then reach out when you’re able to solve a problem. Workable has seen great success generating leads by monitoring competitors’ names. They recently won over a new brand advocate by starting a casual conversation with someone who was unhappy with a competitor’s interface, which led to a demo and a favorable tweet — all by being friendly and transparent. How to win over the competition’s business without being a jerk:

3. Retention It’s easy to get caught up in the desire to grow quickly. We all want to find the hacks that will lead to 100,000 users in one month, etc. However, you shouldn’t lose sight of the customers you’ve already won over. It’s actually very important to keep these customers happy. Consider these stats:

Retention is crucial for sustainable growth, and a lack of focus on retention results in a large spike in growth, followed by a spike in attrition. Customers want to be heard. By listening to what your customers are saying, you can take the necessary measures to make them happy, and keep them around. How to retain customers by listening:

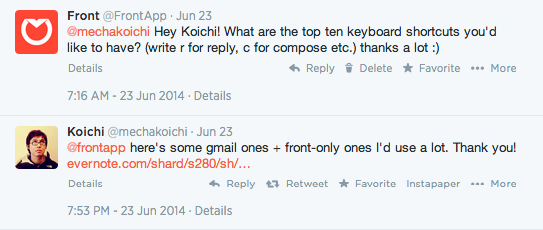

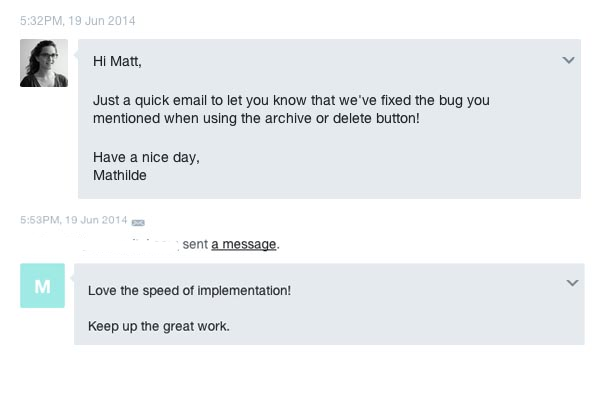

Front did this when selecting which keyboard shortcuts they should offer: Equally important is to work on bugs and glitches. If you say you’ll look into something, make sure to do it, and get back to them! Tighter feedback loops (getting closer to the customer and reducing reaction time) make the customer happier and benefit the company in the long run by creating an opportunity to develop a product with a pre-established customer base.

4. Virality via loyalty programs By analyzing data from 100 clients over 30 days, Portent found that social is the third most influential factor when you define conversions broadly. If your customers aren’t happy, they won’t stick around. If they don’t stick around, they are not able to invite others to try your product over an extended period of time. And virality — the likelihood of your brand or product going viral — is crucial to large spikes in growth. by listening to customers (via support) and potential customers (via listening), you can collect important data at the beginning of your relationship to create customer personas. These can then be used to develop custom loyalty programs that will lead to increased shares to relevant audience. How to maintain consistent virality:

Wrapping it up When deciding on what marketing and community activities to invest time and resources in, it’s only fair to want to know what the return will be. As outlined above, the financial return of listening to current and potential customers is evident, but its value goes beyond just revenue. Joining the right conversations at the right time also contributes to brand awareness, credibility, and long term relationships, all of which are invaluable. _____________________________________________________________________________________________ This is an edited version of a post originally posted at http://blog.mention.com/ by Shannon Byrne who is Mention’s Content & PR Manager, she crafts words, creates strategies, and recruits loyal advocates. She’s based in New York. Get in touch with her at @ShannnonB. You are free to re-edit and repost this in your own blog or other use under Creative Commons Attribution 3.0 License terms, by giving credit with a link to www.startupcommons.org and the original post. Most entrepreneurs just use customer interviews for data, but there are easy ways to turn these potential customers into paying clients. The lean startup methodology took what they taught in MBA classes and turned it upside down, completely changing the way most of us thought about entrepreneurship. No longer was starting a business about projections and management titles. Instead, it changed into experiments and data.

While customer interviews are a big part of finding your value proposition, they also can be a perfect time to build leads. Just because you're still looking to find insights doesn't mean you should stop selling. With a little preparation, you can discover insights about your business model and score a sale. Here are some ways to do both. Step 1: Once you identify their problem, dig deeper It's essential that when you start interviewing customers, you don't have any loaded questions. You want the people you're interviewing to be completely open with you. Swaying or selling them too early will ruin the advice you need for your business. Often you can tell you're getting good data if your customers start getting emotional about the problem. When you hear this, they've given you a path to future business. Once you identify the problem that's causing them stress, dig into the problem deeper. Start by asking what's been the cause of the problem, and ask them how much they are spending to fix the issue right now. Go into how much time they are spending trying to solve the problem. After a few minutes, they'll start spouting off valuable information. This not only gives you information but also opens up your customers' minds about how important the problem is. No one typically takes the time to ask the questions you're asking, so many customers don't think of finding a solution. When you open up customers' minds about how big the obstacle is, they'll become more interested in what you're doing. Step 2: Pitch a solution, even if you don't have one After customers've found the problem, this is where most entrepreneurs stop their interview. Happy with the data they gathered, they thank the person for his or her time and walk away. When you do this, you miss a perfect opportunity to generate business. Here your customer is with a huge problem, and you're going to walk away? No. Instead, pitch a solution, even if it's off the top of your head. When I tell people this, they usually ask, "Why would I pitch a solution that I haven't built?" The answer is because you want to find out exactly what needs to be built to make revenue. Next time you're in this situation, pitch them a hypothesis you have that you think will work and see how they respond. If they don't like it, awesome--you shouldn't build that. If they do like it, now you can ask them if they'd be interested in your showing them a demo in the future. If they answered yes to liking your solution, they'll almost always be open to seeing a demo. Now you know your customer's problem, and know at least one solution a customer would be interested in buying. Step 3: Track results and close sales Don't stop interviewing customers once you have one who you've sold your solution to. Instead, keep conducting interviews until you get to about 100 quality ones. Then look back at the interviews and see which was the most successful solution you pitched. What were customers willing to pay for? Once you've looked at the data and you have enough customers to make it worthwhile, contact those customers. Schedule a demo in the future and build your minimum viable product in the meantime. While the product is being built, schedule more interviews. Next, build some quick mockups and start showing them around. This could also be a great time to raise early capital if you need to. Most entrepreneurs think you need a finished product to raise capital. False. Investors will tell you that it's much better to have 10 customers lined up and no product than it is to have a finished product with no buyers. Most companies don't fail because they never get a product off the ground. They fail because they can't get sales. ______________________________________________________________________________________________ This is an edited version of a post originally posted at http://www.inc.com/ by AJ Agrawal who is an entrepreneur, writer, and speaker. He is the CEO and co-founder of Alumnify Inc. You are free to re-edit and repost this in your own blog or other use under Creative Commons Attribution 3.0 License terms, by giving credit with a link to www.startupcommons.org and the original post. Startups often represent excitement in the small business world, because of their ability to innovate with great new ideas. Some even grow into giants that become household names and many have created products and services that make our lives easier. Despite a major bump in the road with the recent recession, startups have still grown by 49 percent since 1982. And in their first year, new startups create an average of three million jobs. Obviously, these small businesses serve an important function in our economy. Take a look at the infographic below and find out more about the world of startups, from the best places to launch them to their survival rates and more! This is an edited version of a post originally posted at The Payroll Blog, by Stefan Schumacher is the editor of The Payroll Blog. He has 10 years of experience as a journalist, including as a producer for syndicated radio, a newspaper reporter and editor, and a trade magazine writer and editor. You can connect with Stefan on Google Plus. You are free to re-edit and repost this in your own blog or other use under Creative Commons Attribution 3.0 License terms, by giving credit with a link to www.startupcommons.org and the original post.

Every startup will have a passionate entrepreneur behind it who fell in love with an idea enough to give it his all. But to succeed, that is not enough. Others have to fall in love with your idea too. Others include investors. Here are the top traits that emerged out of the discussions. These are 3 key questions investors will seek answers from entrepreneurs before deciding on funding the startup.

1) Do you have the guts and drive to cross the dark valley? “When an entrepreneur succeeds, there is so much glamour and halo attached to them. What is forgotten or undervalued is the walk through the dark valley entrepreneurs go through,” Vani Kola, Managing Director, Kalaari Capital, told us. Before she became a VC, Vani Kola had built two successful companies in Silicon Valley and exited them with billion-dollar valuation. “There are times when you can’t access capital, nobody believes in your idea, and even when you are winning or think you are winning, nobody really gives any value to the growth you are creating. Sometimes you don’t know how in the next six months you can take your business to the next level. There are so many lonely, dark spots in the growing of your business. As I have experienced those personally, I look at an entrepreneur and see, do they have the guts and drive inside them to cross that black hole? Will they get consumed by that? Will they quit or will they persevere?” This is one quality she looks for in an entrepreneur. “That elusive quality of perseverance — People who can compartmentalise these inevitable problems, which are costs every entrepreneur has to bear, and have immense faith on their product or service, and have a deep passion to pursue it — is something that I, having been an entrepreneur myself, empathise with. On the days things don’t go great, this quality will see the entrepreneur through,” she says. 2) Can you transmit your passion and faith to the investor? At the stage of seed and series A round of funding, an entrepreneur doesn’t have the numbers to back him, and therefore investors have a tough decision before them. “You don’t know whether the business will take off or taper off; you don’t know whether the entrepreneur who delivered the business from ten thousand to five millions can actually build a business that looks like it can go to 50 millions. You don’t know whether the team is fully in place to do that. You don’t know whether the market sizing is yet niche or is it going to grow to a 20 million or is it going to cross that 100 million mark which everybody is looking for. And therefore an investor is far more hesitant,” explains Karthik Reddy, co-founder and managing partner of Blume Ventures. “The investors who eventually end up cutting the cheque are those who become equally passionate about solving all those questions. They see that spark in the entrepreneur. They see that market opportunity, just as the entrepreneur sees it. At seed, it is probably an extreme version of that shared passion and faith.” 3) How good is your team or can you build a great team? However good your product is, however good a coder or business head you are, without a complimentary team member or without the ability to build a great organisation you are not going to survive and make it to series A, Karthik Reddy says. “The learning from three years of seed investing is that the team is more important in our evaluation matrix as we mature as a fund. Without a good team, even if you somehow make it to series A, you are probably going to falter before you get to series B, leave alone grand hundred million exit stories.” According to him, investors should walk away from the opportunity, however best the idea might be or however much they relate to the idea if the team isn’t strong enough or the entrepreneur looks unlikely to be a good team leader. “After all, an investor is not going to run the startup for the entrepreneur. So fundamentally, if they are not going to make their business work themselves, you shouldn’t invest in it.” _____________________________________________________________________________________ This is an edited version of a post originally posted at yourstory.com, by Malavika Velayanikal is Executive Editor of YourStory.com and Innovation Junkie. You are free to re-edit and repost this in your own blog or other use under Creative Commons Attribution 3.0 License terms, by giving credit with a link to www.startupcommons.org and the original post. Singapore has been ranked as one of the best places for startups in Asia and around the world. It is well-positioned geographically, offers great infrastructure and logistics, as well as diverse, well-educated talent pool. Singapore is strategically located within hours from fast growing economies such as China and India and consistently attracts the best and brightest minds from different parts of the world. Venture funding, government support and developed startup ecosystem, together with features mentioned above makes Singapore an attractive place for entrepreneurs. more than 50. Let’s have a closer look at some incubators and accelerators in Singapore.

1. Golden Gate Ventures It is an early stage incubator helping internet startups build and launch successful companies across Southeast Asia. Golden Gates Venture’s founding partners share a rich background building successful Silicon Valley startups and managing investments in Silicon Valley and Asia. What is interesting: For startups at their Ideation and Concepting stages, Golden Gate Venture offers 100 Day Bootcamp Program, which is run once or twice per year. Since March 2012, Golden Gate Ventures has been accredited as a Technology Incubation Scheme (TIS) incubator by Singapore’s National Research Foundation. Results: Last year Golden Gate Ventures invested $10 million into startups in their first year. The portfolio includes RedMart.com (online grocery), Coda Payments (mobile payments), and Nitrous.io (web dev tools in the cloud). 2. The Joyful Frog Digital Incubator The Joyful Frog Digital Incubator is recognized as the most successful in Southeast Asia. It is also the oldest among the pack, which should highlight why the company has the most comprehensive, systematic and consistent programs for a wide range of startup companies. The Joyful Frog Digital Incubator piloted its startup accelerator programme in 2012. Over two years JFDI startups raised over $ 7.2 million in seed funding. What is interesting: consistently achieving 60%+ success taking startups to investment in 100 days. Typical startups raise around $ 550 000. In exchange for a minority stake every team, who has been selected for the program is offered a package including cash investment, mentoring, working space. Results: 38 startups have graduated, out of those 34 are still active. 3. Jungle Ventures Jungle makes seed to early Series A investments across Asia Pacific and also operates an early stage accelerator in Singapore. Founded in 2011 with focus is on early stage investments into Singapore, India, South East Asia and other regional hotbeds of innovation. What is interesting: Startups through the seed fund accelerator can look to get: S$50-500K in startup funding, co-investment by 500 Startups, a leading SV based fund, and more. Results: Current portfolio companies include micro-lending platform Milaap, mobile commerce app ShopSpot, and vacations rental site Travelmob which was acquired by Homeaway last year. So far 27 investments has been made, 24 startups still active and 3 successful exits.  Start-up ecosystems around the world are scaling new heights. Startups raising millions of dollars and numbers are growing. Here are 9 things to consider before raising funds for a start-up: 1. Never have more than 3 founders Too many cooks spoil the broth. Having 2-3 founders is an ideal choice. In case you need more experts, you can always hire them. In rare cases more than 3 founders stick together; if the number is more, ultimately, it boils down to 2 or 3. Having one founder is also a bad option. Having different perspectives and divided risks is always a favourable position to be in. 2. Analyse the market; the idea may be good, but the market may not be ready It is primarily important to interpret the existing market scenario in terms of your idea. Broadcasting your idea at the right time is where most of the startups fail. Therefore, first analyse the market and then take a call. If needed keep patience and wait for the market to develop according to your perspective. 3. Pick the right mentors Having the right mentors to guide you and help you manage risk is a blessing in disguise. Even though there are no hard-and-fast rules of choosing a mentor, make sure that your frequency and belief matches. A mentor should believe in your idea and ambition, as a result, making your journey easy and a learning experience. 4. Maintain your accounts A list of expenses of the previous and the upcoming months should always be maintained. This helps you keep track of where the money is going and how much money will be needed. As a result, while going to an investor, you can always show them the accounts and logistically present the amount of funds required. 5. Ensure financial stability in your personal life Giving up an existing job to start a venture is quite a challenging task. Knowing well that the risk may or may not bear fruit, it is of utmost importance to ensure that all the debts are cleared. Also, make sure that the medical insurance, family savings and credit cards are in place. Alongside, keep a minimum runway of 9-12 months. Once all the basic things are taken care of, it will become easier for the risk taker to concentrate on his venture. 6. Family money Keeping personal reputation at stake is riskier. Considering that most startups fail, ideally, family money should not be more that 5-10% of the total investment. 7. Consider funds as a bonus Planning a startup on the basis of bootstrapping is considered to be an ideal one. This helps you concentrate on your business completely rather than hunting for an investor. Also, this will help you control the company completely without any pressure from outside investors. 8. Go to 3-4 investors see what they are asking for Meeting an investor can be a learning experience. Listen to all the questions he asks for after you give your presentation and make a note. Remember, those are the areas the investor is not comfortable with. The more you meet investors, the more you will be able to understand the loop holes in your venture. 9. When a startup does not work, it is good to accept it The bitter truth is that approximately 80-90% of start-ups fail. It is good to make your call and move on if things don’t fall into place. Of course, this should be the last resort but as a risk taker, remember that at times you need to let things go. ___________________________________________________________________________________________ This is an edited version of a post originally posted at yourstory.com, by Richa Maheshwari (reporter from Yourstory.com). You are free to re-edit and repost this in your own blog or other use under Creative Commons Attribution 3.0 License terms, by giving credit with a link to www.startupcommons.org and the original post. |

Supporting startup ecosystem development, from entrepreneurship education, to consulting to digital infrastructure for connecting, measuring and international benchmarking.

Subscribe for updates

Startup ecosystem development updates with news, tips and case studies from cities around the world. Join Us?Are you interested to join our global venture to help develop startup ecosystems around the world?

Learn more... Archives

December 2023

Categories

All

|

- Startup Commons

- Business Creators

-

Support Providers

- About Support Providers

- Learn About Startup Ecosystem

- Startup Development Phases

- Providing Support Functions

- Innovation Entrepreneurship Education

- Innovation Entrepreneurship Curriculum

- Growth Academy eLearning Platform

- Certified Trainers

- Become Growth Academy Provider In Your Ecosystem

- Growth Academy Training On-Site By Startup Commons

-

Ecosystem Development

- About Ecosystem Developers

- What Is Startup Ecosystem

- Ecosystem Development

- Ecosystem Development Academy eLearning Platform

- Subscribe to Support Membership

- Ecosystem Operators

- Development Funding

- For Development Financiers

- Startup Ecosystem Maturity

- Case Studies

- Submit Marketplace App Challenge

- Become Ecosystem Operator

- Digital Transformation

- Contact Us

- Startup Commons

- Business Creators

-

Support Providers

- About Support Providers

- Learn About Startup Ecosystem

- Startup Development Phases

- Providing Support Functions

- Innovation Entrepreneurship Education

- Innovation Entrepreneurship Curriculum

- Growth Academy eLearning Platform

- Certified Trainers

- Become Growth Academy Provider In Your Ecosystem

- Growth Academy Training On-Site By Startup Commons

-

Ecosystem Development

- About Ecosystem Developers

- What Is Startup Ecosystem

- Ecosystem Development

- Ecosystem Development Academy eLearning Platform

- Subscribe to Support Membership

- Ecosystem Operators

- Development Funding

- For Development Financiers

- Startup Ecosystem Maturity

- Case Studies

- Submit Marketplace App Challenge

- Become Ecosystem Operator

- Digital Transformation

- Contact Us

RSS Feed

RSS Feed