|

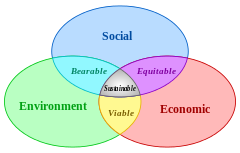

In the United Nation’s World Economic and Social Survey 2013, the Department of Economic and Social Affairs stated that “unless human development and environmental protection goals are integrated, they will remain in competition, jeopardizing both sets of goals.” How can we reduce global income inequality, lift over 1 billion people out of extreme poverty, and reverse environmental degradation simultaneously? This complex issue requires a fundamental shift in how we approach economic development. Governments need to harness the power of public-private partnerships to align human development and environmental protection goals. What follows is a three-pronged strategy to help us pursue sustainable development. 1. Create public-private partnerships for sustainable development Public investment in economic development should focus on leveraging private resources and capital for sustainable initiatives. In order to leverage private resources, the public sector can pursue pooling mechanisms, equity finance, social impact bonds, job bonds, trade credit offsets, and data sharing. The goals of public-private partnerships should be to create an overarching authority, assign roles to key players, and streamline funding for development. In such arrangements, it is essential that the public sector keeps pace with the private sector and that outcomes are measurable. In order to foster sustainable development, public-private partnerships should have two objectives: fostering startup ecosystems in developing economies and using social psychology to alter consumption and investment habits. 2. Foster startup ecosystems in developing economies As our global society becomes more interconnected and the pace of technological change accelerates, fostering startup ecosystems is the most effective way for developing economies to cultivate environmentally-friendly businesses, compete on a global scale, and boost GDP. In order to foster startup ecosystems, the public sector should focus on partnerships that utilize equity finance, data sharing, and trade credit offsets. Regarding equity finance, the public sector can make direct investments, taking stakes in companies, or indirect investments, investing in equity and debt funds. It is wise for governments to pursue both strategies by making direct investments in sustainable, startup-ecosystem builders and participating in sustainable venture capital, as well as real-estate, funds. Data sharing plays an essential role in enabling governments and ecosystem builders to visualize, benchmark, and accelerate startup-ecosystem growth. On the ground level, governments need to convince startups and entrepreneur-support organizations to share their data. This can be done by giving users control of their own data and tying funding incentives to data sharing. At the top level, governments and key ecosystem builders should form public-private partnerships to manage and act on aggregated data. Organizations, such as Startup Commons Global, can assist in the formation of data-sharing partnerships. According to M-CAM, the originator of TCOs, offsets are like coupons for foreign businesses that can be repaid to the country with which they are conducting business in three ways: cash, training/capacity building (3X cash value multiplier), and proprietary technology transfer (10X cash value multiplier). Governments should focus on using trade credit offsets to encourage foreign businesses to train entrepreneurs and supply knowledge to startups within their national ecosystems. While fostering the growth of startups, governments should simultaneously work with the private sector to alter consumption and investment habits so that markets effectively support sustainable startups. 3. Use social psychology to alter consumption and investment habits In “The Psychology of Human Misjudgment”, Charlie Munger, Vice-Chairman of Berkshire Hathaway, outlines 25 social-psychological principles that affect human behavior. By applying a mixture of these principles, public-private partnerships can influence changes in consumer and investor habits, resulting in more sustainable business practices. To alter consumer behavior, state and local governments should use social impact bonds and job bonds to leverage private investment for bolstering the market-penetration efforts of sustainable, local startups, such as aquaponics farms. These innovative financing mechanisms are preferable to subsidies because they minimize downside risk for governments, provide political viability, and give private investors skin-in-the-game. Once private investors have infused capital into startups, the parties should focus marketing and sales efforts around Munger’s principles. For example, they can use Influence-from-Mere Association Tendency to spread local-food preferences within community organizations, such as churches and university clubs. Additionally, they can harness the power of Inconsistency-Avoidance Tendency by having people make public-voluntary commitments to the local food movement. In order to entice investors to fund sustainable initiatives, governments are already experimenting with securitization of small-scale, green loans. These loans can cover sustainable initiatives, such as businesses and homeowners putting solar panels on their roofs. Since people are skeptical of securitization after the 2007-2008 financial crisis, social proof will be essential in creating the market for green asset-backed securities. As a higher number of reputable institutions invest in such securities, more investors will join the movement, due to social proof. By applying simple social psychology, the public and private sectors can collaborate to reduce carbon emissions, while simultaneously opening new markets and creating jobs. 4. What can you do? Whether you are acting in the public or private sector, you can do three things to help with human development and environmental protection:

Are you a consultant or an entrepreneur? - Learn more about Growth Academy Online Training & Certification Programs Download our startup booklet and watch our videos to learn more about our framework to help startups to grow without "reinventing the wheel" and without wasting lot of time trying to connect the dots. The framework is based on the startup development phases and aims to remove the highest universal risks on the startup journey. |

Supporting startup ecosystem development, from entrepreneurship education, to consulting to digital infrastructure for connecting, measuring and international benchmarking.

Subscribe for updates

Startup ecosystem development updates with news, tips and case studies from cities around the world. Join Us?Are you interested to join our global venture to help develop startup ecosystems around the world?

Learn more... Archives

December 2023

Categories

All

|

- Startup Commons

- Business Creators

-

Support Providers

- About Support Providers

- Learn About Startup Ecosystem

- Startup Development Phases

- Providing Support Functions

- Innovation Entrepreneurship Education

- Innovation Entrepreneurship Curriculum

- Growth Academy eLearning Platform

- Certified Trainers

- Become Growth Academy Provider In Your Ecosystem

- Growth Academy Training On-Site By Startup Commons

-

Ecosystem Development

- About Ecosystem Developers

- What Is Startup Ecosystem

- Ecosystem Development

- Ecosystem Development Academy eLearning Platform

- Subscribe to Support Membership

- Ecosystem Operators

- Development Funding

- For Development Financiers

- Startup Ecosystem Maturity

- Case Studies

- Submit Marketplace App Challenge

- Become Ecosystem Operator

- Digital Transformation

- Contact Us

- Startup Commons

- Business Creators

-

Support Providers

- About Support Providers

- Learn About Startup Ecosystem

- Startup Development Phases

- Providing Support Functions

- Innovation Entrepreneurship Education

- Innovation Entrepreneurship Curriculum

- Growth Academy eLearning Platform

- Certified Trainers

- Become Growth Academy Provider In Your Ecosystem

- Growth Academy Training On-Site By Startup Commons

-

Ecosystem Development

- About Ecosystem Developers

- What Is Startup Ecosystem

- Ecosystem Development

- Ecosystem Development Academy eLearning Platform

- Subscribe to Support Membership

- Ecosystem Operators

- Development Funding

- For Development Financiers

- Startup Ecosystem Maturity

- Case Studies

- Submit Marketplace App Challenge

- Become Ecosystem Operator

- Digital Transformation

- Contact Us

RSS Feed

RSS Feed